- Moving the market

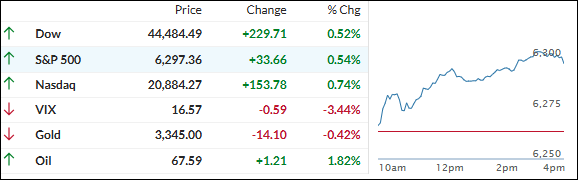

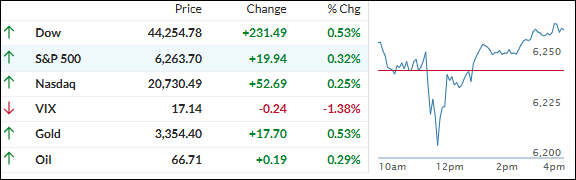

The major indexes got off to a running start this morning, with the Nasdaq leading the charge. Hopes for some good news on the trade front and more upbeat earnings reports fueled the mood, and both the S&P 500 and Nasdaq scored fresh all-time intraday highs.

Big tech was in the spotlight again—Alphabet, Meta, and Apple kicked things off on a positive note, setting the vibe and dragging the rest of the market along for the ride. All eyes are now on Apple and Tesla as the first two Mag 7 names set to report earnings; if they can top expectations, it could add a serious boost to growth in the next quarter.

Trade talks were a hot topic. Commerce Secretary Lutnik stuck to his guns on that August 1 deadline for countries to start paying tariffs, but also left the door open for future negotiations, saying countries can still reach out after the date passes.

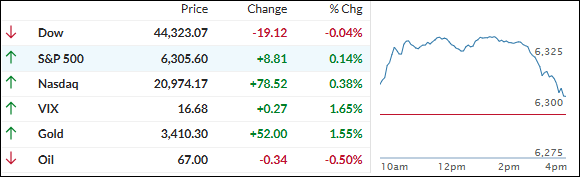

But it wasn’t all sunshine. The Conference Board’s latest leading indicators stumbled for the sixth time in the past seven months—a bit of a reality check as seasonal trends look set to flip from bullish to bearish, and global trade uncertainty creeps a bit higher.

An afternoon bout of selling took the wind out of the indexes’ sails, wiping away the morning gains and leaving the Dow in the red. But the Mag 7 basket once again outperformed the rest of the S&P names, keeping a bit of spark alive.

It was a busy day elsewhere too: bond yields fell across the board, the dollar slipped back to last week’s lows (helping gold jump above $3,400 with a 1.54% daily gain), and Bitcoin did the pump-and-dump routine, ending up about where it started.

ZeroHedge pointed out an interesting parallel between this year’s S&P 500 and last year’s chart action. With seasonal trends lining up, is the market about to repeat history—or are we in for some surprises as summer heats up?

Read More