- Moving the markets

Yesterday’s levitation continued right after the opening bell with the major indexes storming ahead unabated. Today’s driver were improved ADP employment data, which solidly beat expectations. They remain negative but show a massive improvement from the prior month.

Even crashing April factory orders, by the most in some 10 years, could not offset the bullish momentum. As ZH pointed out, year-over-year, factory orders plummeted 22.3%, which was the worst since the financial crisis.

Despite the civil unrest throughout the nation, the prevailing opinion of traders is that the economy has bottomed out and is on its way to a strong recovery, possibly V-shaped—or so the hope goes.

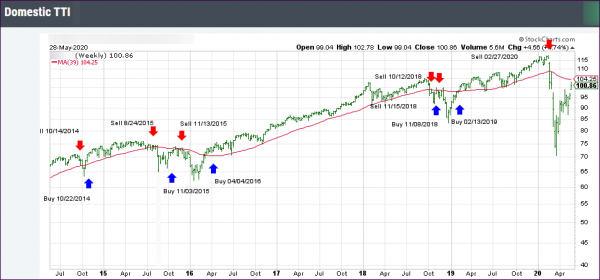

Be that as it may, today’s upswing provided enough upward momentum to push our main directional indicator, the Domestic Trend Tracking Index (TTI), above its long-term trend line into bullish territory, thereby generating a new “Buy” for “broadly diversified domestic equity ETFs and mutual funds.”

In my advisor practice, as I posted, we already had selected positions in sector ETFs and will fill the bucket with more equity ETFs, which I got head start on this morning.

If you are following along on your own, be sure to only invest in the markets, if you establish an exit strategy, and use your risk tolerance as a guide. The markets are at elevated levels, and the dangers of a sudden and massive reversal are always present.

The effective date of this signal will be tomorrow, June 4th, unless I see a huge downturn in the markets, in which case I will delay the execution of my orders.

Read More