ETF Tracker StatSheet

You can view the latest version here.

TRUMP PLEASES MARKETS

- Moving the markets

Nervousness prevailed in the markets with the major indexes sliding, as the world waited with bated breath for Trump’s remarks on potential actions to be taken against China’s ‘violations.’

His highly anticipated news conference came and went, but it did not turn out as stringent and disturbing as traders had feared. That caused the computer algos to shift into high gear and a vertical spike generated a green close except for the Dow.

ZeroHedge likened the ‘soft’ stance towards China as “caving to market pressure:”

In what was perhaps the clearest sign that the president was calibrating his response with one eye on the stock ticker, the president didn’t announce any new tariffs or trade actions, ameliorating fears that he might scrap the “Phase 1” trade deal.

The market cheered the move, as equities surged off their lows of the day as the president simultaneously signaled a more confrontational approach to his dealings with Beijing, while being careful not to escalate an already tenuous situation.

ZH’s headlines about poor economic data points were again a non-event, but they are at least noteworthy:

UMich Sentiment disappoints as “Hope” hits 7-year lows

Chicago PMI plummets to 11-year low as orders and production plunge

US Spending crashes by most ever despite $3 trillion government handout-driven income surge

For the week, the S&P 500 added another 3% closing out the month with a gain of some 7.5%, with SPY now having reached the level we sold at on 2/27/20. In other words, the buy-and-hold crowd has been successfully bailed out again.

As I posted, we have added selective positions from well-performing sector ETFs, and I believe a new domestic “Buy” is in the making and could possibly materialize next week, if the rebound continues unabated.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

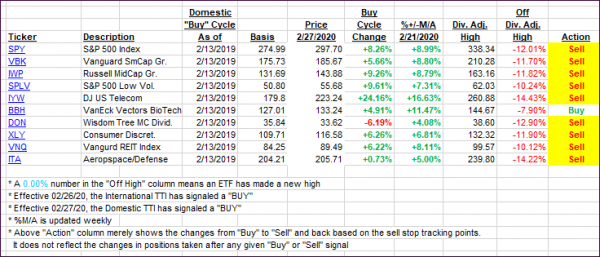

For this past domestic “Buy” cycle, which ended on 2/27/2020, here’s how some our candidates have fared:

Click image to enlarge

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs slipped a tad despite a last hour rebound.

This is how we closed 05/29/2020:

Domestic TTI: -3.40% below its M/A (prior close -2.33%)—Sell signal effective 02/27/2020

International TTI: -6.82% below its M/A (prior close -7.00%)—Sell signal effective 02/26/2020

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

———————————————————

Back issues of the ETF Tracker are available on the web.

Contact Ulli