- Moving the markets

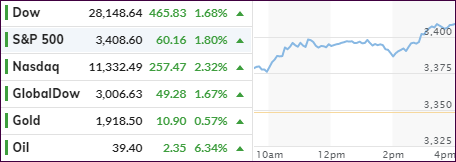

After the markets ended last week with a whimper, there was none of that left today, as the major indexes jumped out of the gate, never looked back, and shifted into overdrive during the last hour.

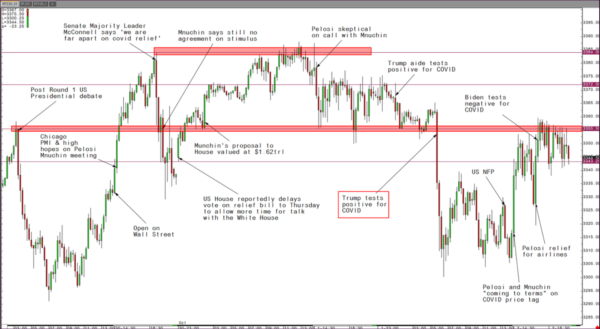

The result was a solid and broad advance supported by various news headlines. One was the announcement that President Trump would be released from the hospital tonight, which eased concerns about election worries.

The other came from the on-off stimulus negotiations with traders growing hopeful that lawmakers can reach a compromise deal—soon. The importance of that was highlighted by Friday’s jobs report, which showed decent numbers but well below expectations.

House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin held an hourlong phone call Monday and discussed “the justifications for various numbers” and “plan to exchange paper” in preparation for further discussions on Tuesday, Pelosi’s chief of staff said.

At least for today, election uncertainty took a backseat, as not only stocks jumped but gold as well, while the dollar tanked along with bonds, due to rising yields.

This week looks to be a quiet one, besides the VP debate on Wednesday night, but there will be FED and ECB meetings and subsequent announcements, any of which could be market moving events.

Read More