- Moving the markets

A solid early bounce in the major indexes hit the skids, found upward impetus for a second time but then lost momentum with all three major indexes doing their best imitation of a swan dive by closing at the lows of the day.

It turned into another disappointing day for the dip buyers, as the midday pullback proved to have not enough support to justify taking new positions therefore handing the bears their second win in a row.

With today’s loss, the Nasdaq has now slipped into correction territory, which means a drop of 10% from its record high scored in November. As I posted yesterday, I ended up liquidating one or our positions, which had lately produced nothing but aimless meandering with a bent towards bearishness.

MarketWatch accurately described the current state of the market this way:

Nasdaq’s pullback from its November high has been led by growth stocks whose valuations ballooned during the pandemic. Shares of Peloton are off more than 80% from their highs. Zoom Video has shed more than 70%. Moderna, DocuSign and PayPal are all down more than 40% from their highs.

This is not surprising, as higher bond yields and generally tighter financial conditions always lead to weakness in those sectors which have superbly benefited by the Fed’s largesse over the past decade. So, it came as no surprise that “value” outperformed “growth.”

Bond yields ended the session slightly lower but not before the 10-year touched the 1.90% level, which turned out to be the reversal moment for equities, and down we went. SmallCaps were hit hard and suffered a Death Cross (50-day M/A below 200-day M/A).

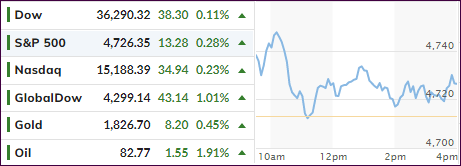

The US Dollar bounced off its YTD unchanged line and closed lower. The shining star of the day was gold, which added +1.6% and reclaimed its $1,840 level.

Read More