- Moving the markets

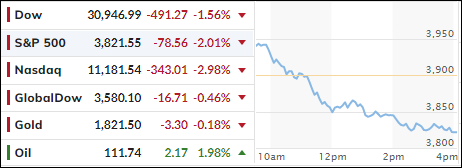

Despite an early pop in the major indexes, the struggle of finding a bottom, off which to launch a bullish rebound from, eluded traders and algos alike. Absent of a major Ramp-A-Thon tomorrow, the last day of the quarter, Wall Street will be left swallowing the bitter pill that the worst half of a year since 1970 has become reality.

Yesterday’s weak consumer sentiment drove another nail in the coffin of bullish hope, as a slowing economy and aggressive Fed rate hikes had occupied traders. Even the occasional “face-ripping” short-squeezes could not deny the fact that we are stuck in bear market territory, and that the fine art of catching a falling knife, AKA bottom fishing, may not be the wisest path of dealing with the current market environment.

The end-result is, as ZeroHedge called it, that rate-hike expectations have stalled (i.e. the market no longer believes the Fed will be hiking as aggressively as it did) as recession fears are brought forward, and more notably subsequent rate-cut expectations have surged (now pricing in more than 3 rate-cuts).

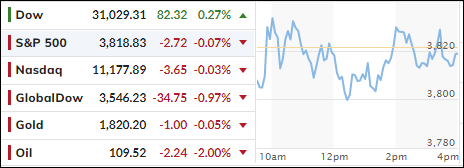

Bond prices rallied, as yields dropped with the 10-year sliding almost 8 bps to close at 3.10%, a substantial decline from yesterday’s high of 3.25%. The major indexes ended up hugging their unchanged lines, but SmallCaps were clobbered and lost around 1%.

The US Dollar continued its bullish rampage, Crude Oil tanked on the day, as did Natural Gas, while Gold pumped and dumped and closed unchanged.

Treading water and going nowhere best describes this session driven by nothing but uncertainty.

Read More