- Moving the markets

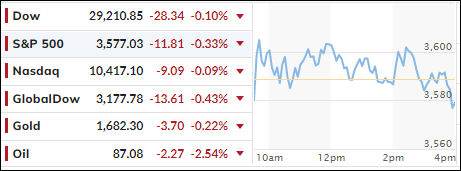

Despite an early 500-point jump in the Dow, supported by strong earnings reports (Goldman Sachs, Lockheed Martin), volatility set in with the major indexes tumbling off their lofty levels. The cause was Apple reporting that it will be cutting iPhone 14 production less than 2 weeks after its debut.

Added ZeroHedge:

The news that there is just not enough demand for the trinkets and beads of the world’s largest company makes one wonder if the consumer is really as strong as the talking heads would like everyone to believe.

Uncertainty reigned and trading was choppy, as many investors seem to lack conviction that this rally has legs. According to my count, we have seen 5 occurrences when, after a rebound, the indexes dumped to make lower lows each time, which is a hallmark of bear market behavior.

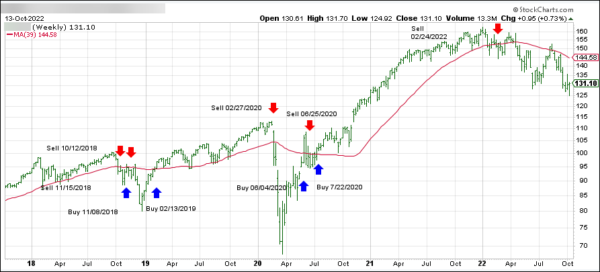

This SPY chart demonstrates what the bulls had to put up with in 2022:

Will this current rebound be different?

Today, another short squeeze helped the bullish cause with the major indexes closing in the green. Bond yields chopped around and ended slightly lower with the 10-year losing its 4% level by closing at 3.99%.

Gold retreated a tad, but Crude Oil stumbled and is threatening to break the $80 barrier to the downside. With the current administration’s plan to announce more SPR releases to lower the price of gasoline at the pump, and a weakening economy, we could see the black gold take a dump into $70s.

Read More