- Moving the markets

Today’s Producer Price Index (PPI) was a mixed bag and turned out to be a yawner for the stock market. While the PPI climbed 0.4% in September, which was twice the forecast of 0.2%, year over year, however, it rose 8.5%, which was an improvement from August’s 8.7% increase.

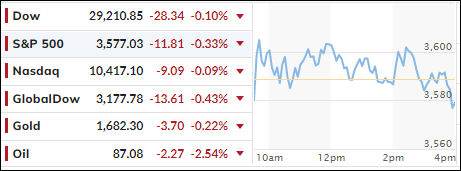

The major indexes interpreted that as inconclusive and spent the session chopping around their respective unchanged lines with not much gained or lost. The S&P 500 was the worst performer sporting a negative -0.33% and notched its 6th day of losses.

The Fed’s September meeting notes were released, as MarketWatch reported:

The minutes showed that the central bank expects to keep hiking interest rates and keep them high until inflation shows signs of cooling off.

On the other hand, one comment in the minutes led to optimism that the Fed might slow its tightening campaign or even walk it back if there was more financial market turbulence.

Of course, traders are always looking for optimism in Fed Statements, but today that hope was dampened somewhat when Chicago Fed President Charles Evans suggested that job losses were an acceptable circumstance:

If unemployment goes up, that’s unfortunate. If it goes up a lot, that’s really very difficult. But price stability makes the future better.

Bond yields slipped, the US Dollar dipped, while Crude Oil dropped for the 3rd straight session to end at $87. Gold gained moderately but has a way to go to reclaim its $1,700 level.

Right now, nothing is more on traders’ minds than tomorrows CPI report. As JP Morgan pointed out, consensus expects to see inflation increase 8.1% from a year ago in September. Anything above the prior reading of 8.3% could put the stock market at risk of a quick 5% tumble.

It promises to be an interesting day, but I think whatever magnitude the initial market reaction may be, it likely will be limited in duration.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

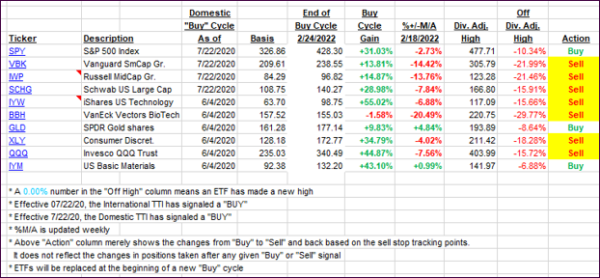

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this closed-out domestic “Buy” cycle (2/24/2022), here’s how some of our candidates have fared. Keep in mind that our Domestic Trend Tracking Index (TTI) signaled a “Sell” on that date, which overrode the existing “Buys” shown for SPY and IYM:

Click image to enlarge.

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -12% point has been taken out in the “Off High” column, which has replaced the prior -8% to -10% limits.

3. Trend Tracking Indexes (TTIs)

Our TTIs slipped again, as the bears clearly have the upper hand.

This is how we closed 10/12/2022:

Domestic TTI: -11.90% below its M/A (prior close -11.44%)—Sell signal effective 02/24/2022.

International TTI: -15.92% below its M/A (prior close -15.66%)—Sell signal effective 03/08/2022.

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

Contact Ulli