- Moving the markets

A relief rally held its ground with the major indexes remaining steady above their respective unchanged lines, as strong bank earnings by Bank of America and Bank of Mellon provided the fuel to sustain the rebound.

Of course, stocks have been in deeply oversold territory, and are hovering near year lows of the year, with the S&P 500 having declined in four of the past five weeks. We have witnessed big moves in both directions, as apprehension has spread through Wall Street causing this roller-coaster type of swings.

Today, the pendulum swung back in favor of the bulls, which also found some encouragement by the markets now moving into the seasonally strong part of the year.

Whether that is enough to propel the rally further remains to be seen and will be impacted by the upcoming earnings season, as well as companies’ outlooks and/or revisions, along with the Fed’s policies in the face of persistently high inflation and an economic slowdown.

As ZeroHedge pointed out, “Friday’s bloodbath was dominated by hedge fund shorting, which set up the market for a major squeeze higher…yet again.” And that is exactly what happened, as the most shorted stocks got squeezed early on, but that was it—no follow through, which could indicate that all of the ammo has been used up.

Bond yields presented a mixed picture with the 10-year rallying back above 4% and closing at 4.02%, while the 30-year followed suit. Yields have now risen for 11 straight weeks, the longest such streak since 1978, as ZeroHedge added.

The US Dollar was in diving mode today, which helped Gold to rally, but the precious metal could not sustain the early gains but closed in the green.

Can this bounce be prolonged? ZeroHedge concluded that it can—at least until the November FOMC meeting—that is if the 2008-2009 analog holds true.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

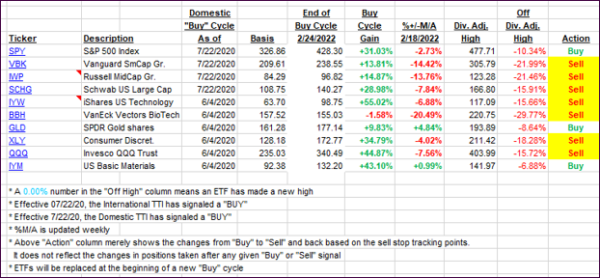

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this closed-out domestic “Buy” cycle (2/24/2022), here’s how some of our candidates have fared. Keep in mind that our Domestic Trend Tracking Index (TTI) signaled a “Sell” on that date, which overrode the existing “Buys” shown for SPY and IYM:

Click image to enlarge.

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -12% point has been taken out in the “Off High” column, which has replaced the prior -8% to -10% limits.

3. Trend Tracking Indexes (TTIs)

Our TTIs advanced but still remain deeply stuck on the bearish side of their respective trend lines.

This is how we closed 10/17/2022:

Domestic TTI: -9.36% below its M/A (prior close -11.29%)—Sell signal effective 02/24/2022.

International TTI: -12.64% below its M/A (prior close -14.32%)—Sell signal effective 03/08/2022.

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

Contact Ulli