- Moving the markets

Despite positive earnings from Microsoft and Google after the close yesterday, the troubles of First Republic Bank (FRC) continued today and overshadowed all news with the stock sliding another 30% on top of yesterday’s 50% dump.

As I have repeatedly pointed out, there is never just one cockroach, a theory which appears to be correct again, as concerns about the banking system were moved to the front burner once more. If FRC gets downgraded by regulators, that would impair their ability to borrow from the Fed, which then would pretty much assure its demise.

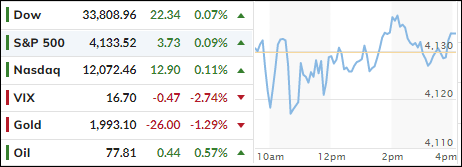

In the end, the markets closed in the red for the second day, except for the Nasdaq, which eked out a gain thanks to Microsoft and Google.

Looking at the big picture, we saw surprisingly better than expected Durable Goods orders, which surged 3.2% MoM, but when looking under the hood, it was not as great as the headline number indicated. Offsetting that was the banking system debacle and the debt ceiling anxiety, all of which combined to sink 2 of the 3 major indexes.

Bond yields were mixed today but rebounded off yesterday’s lows, yet the 2-year was unable to reclaim its much fought-over 4% level.

The US Dollar dropped and popped but closed lower, while gold followed suit but was unable to hang on to its mid-day gains.

As we are nearing the end of April, volatility has picked up considerably, which today pulled our Domestic TTI back below its long-term trend line—but only by a small margin. Please see section 3 below for more details.

Read More