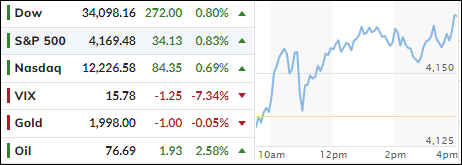

- Moving the markets

Observing the markets daily, sometimes I have to laugh out loud, and at other times I simply have to shake my head in disbelief. The latter occurred yesterday, after Fed head Powell had announced that the banking system was “sound and resilient.”

It was only a few hours later when the next cockroach surfaced, namely PacWest bank, which has been assessing “strategic options,” including a sale. To me, that means that the “sound and resilient” nonsense is simply another failed Fed assessment like “inflation is transitory.”

On that topic, Powell uttered the following:

“We on the committee have a view that inflation is going to come down not so quickly. It will take some time, and in that world, if that forecast is broadly right, it would not be appropriate to cut rates and we won’t cut rates.”

Mixing his hawkish outlook with the constantly worsening banking crisis, you now have the perfect combination of what might give equities a knock-out punch. Today’s sell-off added another notch to the bearish bedpost, as the markets again were unable to stage any meaningful rebound, with the regional banking index KRE taking another hit, as some of its members, like WAL and PACW, were severely clubbed.

The usual short squeeze was conspicuously absent, Bond yields went sideways, with the 2-year closing at its lowest since September 2022, as ZeroHedge elaborated.

The US Dollar went nowhere, but Gold saved the day again by being the “go to” asset class for safe haven seekers.

Apple earnings, due out after the close, could be a game changer tomorrow. Looking at the big picture, however, I am more in tune with the Goldman Sachs trader, who uttered this spot-on remark:

Read MoreWhat’s coming in the markets is like when Indiana Jones was running from the boulder.