ETF Tracker StatSheet

You can view the latest version here.

REBOUNDING ON THE LAST DAY OF THE WEEK

- Moving the markets

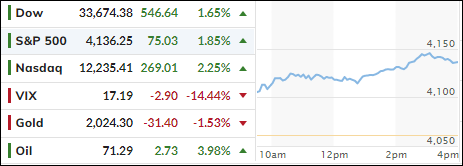

After four straight days of losses, stocks finally managed to find some bullish momentum, which pulled the major indexes out of a deep hole. They still ended the week with a loss, but Wall Street’s darling Apple came to the rescue with better-than-expected quarterly earnings.

Even hotter than anticipated jobs numbers, the economy added 253k vs. a hoped for 180k, did not dent bullish sentiment. The much beaten down regional banking index KRE showed signs of life and advanced some 4.7%, with member banks PacWest and Western Alliance also popping.

All that was helped by a note from JP Morgan upgrading these two stocks. Hmm, what changed from yesterday’s thrashing? Ah yes, a giant short squeeze bailed out Wall Street and the banks, the latter of which are still down hard for the week.

The rebound was happening with full force, despite Bullard’s hawkish comments:

The aggressive policy we pursued in the last 15 months has stemmed the rise in inflation, but it is not so clear we are on a path to 2%.

I am willing to assess the economic data as it comes in but would need to see “meaningful declines in inflation” to be convinced higher rates aren’t necessary.

Again, I think the fallout in the regional banking sector is far from being over, despite today’s comeback, because the liquidity issues that plague all banks, have not been resolved.

For the week, bond yields were mixed, the US Dollar was down for the 7th of the past 9 weeks, while gold and silver both were up with the latter outperforming and the former just ending a tad short of a record weekly closing high, as ZH elaborated.

Leave it up to ZeroHedge to sum up the Fed’s predicament:

For The Fed to fold, the market will have to crash, but the market won’t crash, because everyone knows The Fed will fold and juice stocks back to un-reality…

2. “Buy” Cycle Suggestions

For the current Buy cycle, which started on 12/1/2022, I suggested you reference my then current StatSheet for ETF selections. However, if you came on board later, you may want to look at the most recent version, which is published and posted every Thursday at 6:30 pm PST.

I also recommend you consider your risk tolerance when making your selections by dropping down more towards the middle of the M-Index rankings, should you tend to be more risk adverse. Likewise, a partial initial exposure to the markets, say 33% to start with, will reduce your risk in case of a sudden directional turnaround.

We are living in times of great uncertainty, with economic fundamentals steadily deteriorating, which will eventually affect earnings negatively and, by association, stock prices.

In my advisor’s practice, we are therefore looking for limited exposure in value, some growth and dividend ETFs. Of course, gold has been a core holding for a long time.

With all investments, I recommend the use of a trailing sell stop in the range of 8-12% to limit your downside risk.

3. Trend Tracking Indexes (TTIs)

With a short squeeze ruling the day, the bulls finally came out of hiding. Our Domestic TTI crawled back above its trend line into bullish territory—at least for the time being.

This is how we closed 05/05/2023:

Domestic TTI: +0.68% above its M/A (prior close -1.00%)—Buy signal effective 12/1/2022.

International TTI: +6.33% above its M/A (prior close +5.19%)—Buy signal effective 12/1/2022.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli