Whenever financial markets slide into bear market territory, there are bound to be numerous articles appearing online or in print touting the “benefits” of staying put with your investments. It is as if nothing has been learned from the all too recent bear market of 2000-2003.

Whenever financial markets slide into bear market territory, there are bound to be numerous articles appearing online or in print touting the “benefits” of staying put with your investments. It is as if nothing has been learned from the all too recent bear market of 2000-2003.

MarketWatch featured such a story titled “Grit and bear it.” Let’s look at some of the ideas:

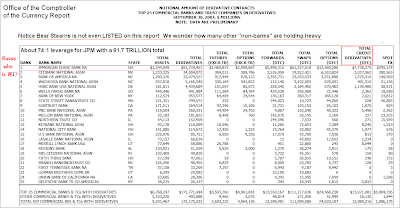

Wall Street giant Bear Stearns is severely wounded and the natural instinct for many investors is to run, not just from financial-services stocks but from the entire market.

But the financial crisis that struck Bear Stearns Cos. Inc. on Friday — while the latest and possibly not the last shoe to drop in the widening credit crisis — is still no reason for investors to dump stocks and hide out in cash or Treasury bonds.

“It’s too late to be bearish, but it’s too early to be bullish,” said Bernard Baumohl, managing director of investment advisory firm The Economic Outlook Group LLC. “Until the dust settles, we’re advising clients to stay put.”

For Baumohl, a model portfolio today would be highly defensive — 40% cash; 50% stocks, mostly outside of the U.S.; and 10% in precious metals. But he wouldn’t suggest overhauling your own portfolio now to fit that cautious bill.

In fact, he expects to boost his clients’ allocation to stocks later this year.

“At this stage we are close to a bottoming in the stock market,” Baumohl said, “but it’s probably going to bounce around at the trough for at least another three to five months. It will be sometime until the second half of the year when finally people will jump back into the market and take advantage of the distressed prices.”

Of course, that’s small comfort now, with Bear Stearns on a precarious edge and investors anxious about what comes next.

“It’s a symptom of the entire financial-services sector,” said Michael Cuggino, manager of the Permanent Portfolio Fund. “I don’t think that ultimately Bear Stearns will be the only one to have this sort of thing occur. I don’t think they’re the only firm that can experience such liquidity crises.”

I just have to shake my head when reading such nonsense. Don’t these people realize that we are in bear market territory and may very well be witnessing the unwinding of the largest credit bubble ever created? Bear Stearns almost collapsed on Friday had it not been for a last minute Fed bailout. Without it, the ramifications for Wall Street might have been devastating. Next time, the Fed or any other while knight might not step in and then what?

These jokers in the above article are touting a model portfolio and talking about a bottom in the market. These stories are very similar to those I remember from late 2000.

My point about this ranting is simply that no one can foresee the future. Prices and price direction are the only things that are real because they can be measured. And right now, price direction points south meaning that if we continue in that direction, bullish portfolios will once again be annihilated.

I prefer reading qualified information from individuals with no axe to grind. I suggest you do the same and stay away from the nauseous repetitiveness of financial reality TV shows. While this may be great entertainment, be aware that’s all it is. My personal tolerance is about 5 minutes when watching botox enhanced individuals attempting to tell me what the market will do in the future or which mutual fund is a great buy.

Keep the big picture in mind; right now, the time is to be conservative and mostly on the sidelines.

Bullish hopes were dashed yesterday when the markets did not follow through to the upside, but meandered downward with the Dow losing almost 300 points.

Bullish hopes were dashed yesterday when the markets did not follow through to the upside, but meandered downward with the Dow losing almost 300 points.