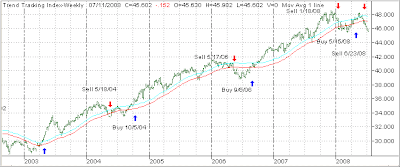

With the markets having retreated into bear territory, I have received many reader questions regarding shorting the market. Nowadays, you have many more choices than compared to the last bear market of 2000-2002.

With the markets having retreated into bear territory, I have received many reader questions regarding shorting the market. Nowadays, you have many more choices than compared to the last bear market of 2000-2002.

With the proliferation of ETFs, you are no longer limited to a few bear market mutual funds, you can now buy with great ease inverse ETFs like SH or SDS, that perform opposite to the S&P; 500 or, in the case of SDS, 200% of that value. Of course, if you go that route, be sure to use my recommended sell stop discipline, because bear market rallies are always lurking around the corner.

However, if you take a longer term view, say 15 years, how much will short selling really contribute to your bottom line?

To get some kind of answer, I went back to the previously reviewed book “Trend Following” by Michael Covel.

Michael has researched the investment results of many of the well known CTAs (Commodity Trading Advisors) and detailed some his findings of various trend following systems in his excellent book (p. 270). As you may know, CTAs are probably the most aggressive investors when a short selling opportunity presents itself.

One example, which I found very typical covers a period of 15 years (1990 – 2005) and shows the following annualized gains:

Long + Short: +19.59% (515 trades)

Long Only: +18.86% (368 trades)

Short Only: 5.64% (147 trades)

As you can see, long-term, the short positions have not contributed much to the overall return.

Before you get all excited about this approach, keep in mind that these are leveraged investments and the downside as always is the Draw Down, meaning how much the portfolios have fluctuated:

Long + Short: -46.96%

Long Only: -75.77%

Short Only: -60.36%

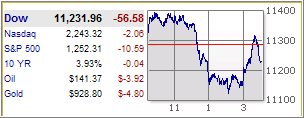

For most investors, this is not an easy pill to swallow to see portfolios drop by these numbers. I know, because many people are having difficulties with the fact that the current bear market has shaved off a very modest 10% off the value off their holdings.

This is just one example of how much short selling contributes to the bottom line. If you happen to be a conservative investor you can see that, based on the above numbers, you do not need to be actively shorting the market just because your friends are. If staying on the sidelines is more fitting to your risk profile then by all means do so.

These numbers simply point out that, long-term, short selling for the individual investor may not have the impact on returns as you thought it might.