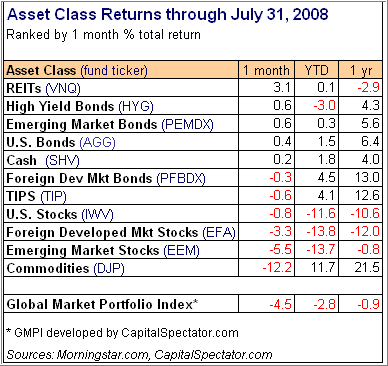

Seeking Alpha featured a story titled “REITs Pop While Commodities Flop,” showed a summarized table showing various assets class returns of various time periods. Let’s take a look:

While commodities were the hot item for most of this year, the trend has clearly reversed as the sharp 1-monht drop of DJP shows.

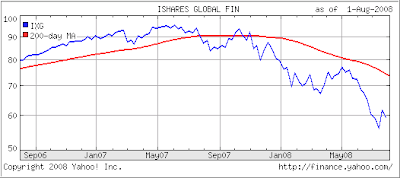

REITs, as represented by VNQ, have shown a nice pop to the upside, but are they worthy investment at this time? We’ve owned VNQ over a year ago before the real estate bubble burst, so let’s take a look at a 2-year chart again:

A chart is worth a thousand words. It’s is obvious that the long-term trend is still down, although back in May, this ETF showed signs of life. As is the case so often in bear markets, counter-trend rallies can be fast and furious, but they usually have no staying power.

It pays to be cautious, especially with real estate, residential and commercial, not having seen the end of the down trend. One day, VNQ may provide us with good upside potential again, but right now is not the time to be a gambling fool.