- Moving the markets

The Fed dashed the hopes of traders who were looking for some hints of interest rate cuts in the latest meeting minutes. Instead, the central bank said it would keep its policy “restrictive” to tame inflation, which could rise further. The Fed kept the interest rate unchanged at 5.25% to 5.5% in its meeting on Oct. 31-Nov. 1.

“Participants continued to judge that it was critical that the stance of monetary policy be kept sufficiently restrictive to return inflation to the Committee’s 2 percent objective over time,” the minutes said.

That sounds pretty hawkish, but the market is still betting on rate cuts starting from May next year. Is that wishful thinking or realistic expectation? History suggests that the Fed usually waits for about 11 months after the last rate hike before cutting rates again. And the last rate hike was in December 2022.

Meanwhile, the economy is showing signs of slowing down, as some major retailers lowered their sales outlooks and missed revenue expectations. Lowe’s stock price fell more than 2%, Best Buy dropped 2.7%, and American Eagle plunged 17.3%. Ouch.

The housing market is also cooling off, as existing home sales hit their lowest level since 2010 and reached a record low in the West. This dragged down the US Economic Surprise index and the Financial Conditions index, which measure how the economy is performing relative to expectations and how easy it is to borrow money.

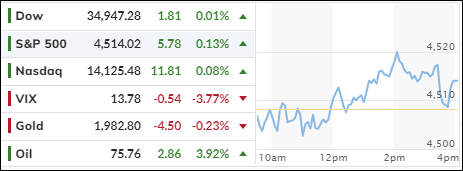

The stock market retreated, as the short squeeze that lifted the market yesterday ran out of steam and the big tech stocks gave up some of their recent gains. The bond market was mixed, the dollar bounced back, but gold shone brightly and reclaimed its $2k level.

All eyes are now on Nvidia’s earnings report tonight, which could be a make-or-break moment for the chipmaker. Will it follow the footsteps of its rivals AMD and Intel, which reported disappointing results amid the global chip shortage? Or will it surprise the market with strong growth driven by its gaming and data center segments?

Read More