One of my favorite authors, Robert Ringer, had these thoughts in regards to solving the financial crisis featured in an article called “The Great Bailout Stall:

One of my favorite authors, Robert Ringer, had these thoughts in regards to solving the financial crisis featured in an article called “The Great Bailout Stall:

Now that the Demopublicans and their media friends have, through the magic of doublespeak, transformed the massive and fraudulent bailout bill into a heroic “economic rescue plan,” most Americans can refocus their couch-potato efforts back on reality TV shows, football, and electronic gadgets. After all, the problem has been resolved, right?

Earth to American taxpayers: Nothing has been resolved! In fact, dishonest and cowardly Congressmen/women have virtually assured us, through their actions, that the financial crisis will get worse – much worse.

Nevertheless, I’ve learned, through experience, that no one can accurately predict the timing of economic events, because everything is controlled by an entity – the government – that has a monopoly on (1) printing “money,” (2) taxing its serfs, and (3) using force against anyone who dares to defy its will.

If you could print your own money, make others give you their money, and use force in the marketplace to achieve your ends, do you think you might be able to prolong the consequences of your actions? You would, of course, eventually fail. But it would be impossible for anyone to predict at what point in time your misdeeds would bring you down.

The most practical solution to America’s financial ills is to face the music- now, rather than later. The major question of our time has not been raised by anyone in the media: Are you prepared to lower your standard of living – even suffer – so your children and grandchildren can enjoy a better standard of living and not have to suffer worse than you?

Put more directly, are you prepared to face the moral and Constitutional reality that you are entitled to absolutely nothing other than the right to pursue your own success and happiness in any way you so choose, so long as you do not commit aggression against others?

In other words, are you prepared to go “cold turkey” in exchange for freedom? I’m sorry to say that my personal take on the pulse of our country is that not many people are willing to give up (a false sense of) security in exchange for freedom. Which is why even the staunchest conservatives in the Republican wing of the Demopublican Party will not name specific government programs they would be willing to eliminate. (Not cut – eliminate.)

When the hopeless, stand-for-nothing J. McBama talks about “letting the marketplace sort things out for the economy,” he is quick to assure voters that the government will, of course, pay unemployment benefits to those “in need,” retrain (as in $$$) people who have lost their jobs, etc., etc., etc.

Message to J. McBama: It’s not the government’s Constitutional role to shore up people who have lost their jobs – nor does it have a moral right to do so. Job loss and job retraining are simply none of the government’s business.

And, contrary to what politicians, the media, and most Americans seem to believe, it’s not the government’s job to “get the economy moving again.” Sorry, but it’s simply not in the Constitution. Economic stability can be created only by allowing the market to take its natural course and rid the economy of synthetically created wealth.

In more blunt terms, what I’m talking about here is a deflationary depression. Make that a massive deflationary depression. As I’ve said so often, we’ve been in an invisible depression for at least 30 years. What I’m advocating is that we ignore the daily lies that come out of Washington and demand that the invisible depression be allowed to reveal itself.

I can already hear some readers saying, “That Ringer is a really bad guy. He lacks compassion.”

Not so. On the contrary, I have a great deal of compassion for the millions of people who are hurting financially. And, quite frankly, it makes me angry when I think about what politicians have done to bring about so much of their pain and suffering.

I know what it’s like to be homeless. I know what it’s like to have your gas and electricity shut off. I know what it’s like to be without a car. I know what it’s like to eat cold, canned soup for dinner. But I’ll tell you this: The only way I ever improved my bad situation was to look in the mirror, face the reality that suffering was going to be an integral part of my life until I could turn things around on my own, and work my tail off – sometimes 18 to 20 hours a day. I never applied for welfare and I never asked anyone to retrain me. I lowered my standard of living… I suffered… and I worked hard.

Now I’m going to share a somewhat gross analogy with you to help make my point that the only viable solution to America’s financial demise is to allow the invisible depression to become visible as quickly as possible.

Many years ago, before modern medicine had come up with more humane procedures for dealing with hemorrhoids, I suffered through a period of extreme discomfort. Over the course of about a year, I visited two proctologists, but nixed letting them put me under the knife. Instead, they gave me a variety of salves and ointments to deaden the pain. As a result, I had “invisible” hemorrhoids. They were still there, of course, but by applying medication, I could pretend they weren’t. What a marvelous delusion.

Finally, it got to the point where salves and ointments could no longer bail me out. In desperation, I went to a third doctor – one who’d been touted in a newspaper article as “the best in his field.” After a cozy little examination, he said to me: “I’ll give it to you straight. Your problem will never get better on its own. The only way to get rid of it is through surgery.”

I was in such pain that, without even thinking about it, I blurted out, “When can you do it?”

“Tomorrow,” he said. “It’s my day in surgery.”

Without giving myself the opportunity to mull over it (and probably put it off), I impulsively said, “Okay.”

Out of respect to your sensibilities, I won’t give you the gory post-operation details. Let it just suffice to say that, for the first few days, I regretted having been so impulsive. But soon I started to get progressively better. And within a month, the entire experience was nothing but a bad dream – and I was pain-free. I had survived the medical equivalent of a deflationary depression by getting it over with.

Now, I ask you to help spread the word – friend by friend, neighbor by neighbor, coworker by coworker – that what America needs is a hemorrhoid operation, not more bailouts. That means a lot of pain and suffering for all of us. And, make no mistake about it, we deserve it for having allowed our elected officials to turn the Constitution upside-down and dupe us into believing that we are obliged to answer to them rather than the other way around.

The time has come for us to tell the politicians that we don’t want any more economic salves and ointments. The only way for things to get better is for government to get out of the way and stop making things worse. I say: My fellow Americans, ask not what your country can do for you, but what you can do for yourself.

Whether you agree with Robert’s points or not, they are bound to make you think. Feel free to post your opinion by clicking on the “comment” label below.

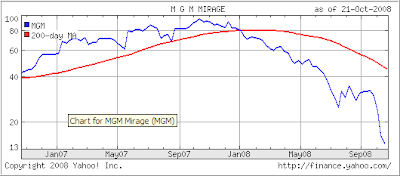

Big and ugly is the only way to describe yesterday’s market fall in which the widely followed S&P; 500 index fell 6.1% to its lowest level in five years.

Big and ugly is the only way to describe yesterday’s market fall in which the widely followed S&P; 500 index fell 6.1% to its lowest level in five years.