Just found a story in MarketWatch titled “An active manager can offer protection,” which features an interview with Dan Wiener, editor of the Independent Advisor for Vanguard Investors.

It’s a rehash of the battle of the indexing folks against those preferring to use actively managed funds. Dan said that “fund buyers should be looking first for great management — and particularly management with a history of protecting shareholders during down markets — so that they have the confidence to stick with a strategy in all conditions.”

He then added that “one of the flaws to an indexing strategy is the downside protection, with many investors finding it hard to ride out market downturns when they are bearing the full brunt of the fall. Good managers make up for their additional cost, by providing a shield against those kinds of losses.”

Huh?

I am not making this up. Where was this guy during the last bear market? Read that again: “fund managers provide a shield against (bear market) losses?” Has he not looked at any chart to see how Fidelity equity funds fared during the period of 2000 to 2003?

If you held any Fidelity funds during that last bear market, please tell me that I am wrong and that you actually owned such a fund where the manager “provided a shield against losses.”

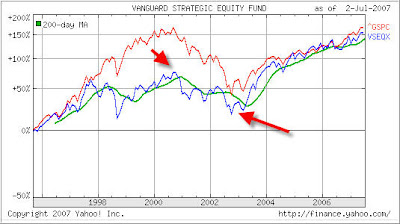

He actually mentions a couple of funds (with the benefit of hindsight), namely VSEQX and VMGRX. The latter wasn’t around during the bear market, so let’s look at VSEQX compared to the S&P; 500:

The arrows indicate the approximate range of the bear market. One thing that is glaringly obvious is that VSEQX was a poor performer at that time when compared to the S&P; 500. Subsequently, it gave back less during the bear market. The past 5 years, it has barely kept up with the S&P.;

My take on this is still the same: This should not be a battle as to whether indexing is a better approach than using actively managed funds, because both will lose in bear markets to varying degrees. Use a combination of both, and apply the trend tracking discipline, which at least gives you a fighting chance to keep most of your portfolio intact when the markets head south in a big way.

Comments 2

Hi Ulli,

Just thought I would drop you a note regarding your “blogspot” on VSEQX vs the S&P500.; Thing is, a lot of times people write articles that are “reactive”. I think Weiner is looking at chart since 1997, while you are looking at chart since 1996. If you go to morningstar.com and click on Total Return link for VSEQX, you will see a comparison between VSEQX, its midcap benchmark (according to M*, of course) and the S&P; 500. And you’ll see that VSEQX looks much better then.

Basically I feel an argument can always be made anyway one wants. It all depends on time periods chosen. I think you are right of course and the for the first time can appreciate “trend tracking” that you practice. I’m not rich enough to afford your services yet, but I’ll try my best to incorporate your TTI into my investment plan.

Kind Regards.

RB

RB,

Thanks for your comment.

My main emphasis was on the fact that fund managers will not provide a shield against losses.

Ulli…