Reuters reports that “Flood of ETFs promising hedge style returns.” Let’s take a look at some highlights:

Reuters reports that “Flood of ETFs promising hedge style returns.” Let’s take a look at some highlights:

Money managers are flooding the market with exchange-traded funds (ETF) and mutual funds designed to give even the smallest of investors access to hedge fund returns without all the usual restrictions or hefty fees.

IndexIQ Advisors, a start-up firm that seeks to replicate hedge fund performance, on Tuesday launched the index-based IQ Hedge Macro Strategy Tracker ETF (MCRO.P), about 75 percent focused on emerging markets and 25 percent on global trends. The offering joins the IQ Hedge Multi-Strategy Tracker ETF (QAI.P), which began trading in March and is up 17 percent.

Both ETFs charge a fee of 0.75 percent and invest in a range of ETFs, with the exact mix determined by computers looking to mimic hedge fund returns.

And there’s a lot more to come. IndexIQ in April told the Securities and Exchange Commission that it plans to launch as many as 15 exchange-traded funds emphasizing different hedge fund strategies. The next offerings to come include a natural resources ETF, which will invest in stocks, and an inflation- hedged product buying a mix of commodity and equity ETFs.

…

Davidow says index funds offering hedge fund strategies can be beneficial to all investors, muting ups and downs and generating returns not tied to the overall market.

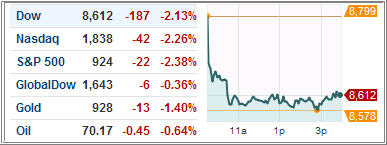

Since its launch nearly one year ago, the IQ Alpha Hedge Strategy IQHIX.O mutual fund has been flat, which is good compared with a 22 percent decline in comparable hedge funds and a 25 percent fall in the broader U.S. equity markets.

Disappointing hedge fund performance last year and redemption blocks have angered big investors and created a rare opening for new offerings. Firms such as IndexIQ, WisdomTree Investments and Grail Advisors intend to take advantage of the popularity of ETFs while offering strategies that used to be exclusive to the super rich.

[Emphasis added]

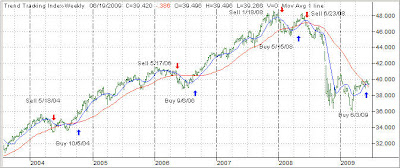

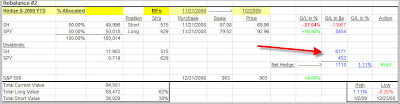

Using a hedged approach to investing can offer tremendous benefits as I have been trying to explain over the last 3 months. However, in the past, most of those strategies, as represented to the average investor via Long/Short funds, have been expensive and not yielded satisfactory results.

Only time will tell if any of the above mentioned ETFs will live up to their expectations. I believe that using my SimpleHedge Strategy is a step in the right direction and, while cost effective, it is well suited for the individual investor who likes to have some means of control over his portfolio no matter what size.