I must admit that I have been having a lot of fun lately. Not the kind of fun you are probably thinking about; it was more the kind of fund that results from satisfying a curiosity as to what might happen when various scenarios are applied to an investment discipline.

Sine I published my free e-book “The SimpleHedge Strategy” back in March, a lot has happened it terms of uncovering the enormous possibilities that exist when using such an approach. Today, I will share one of those results with you, and I’m sure that it amazes you as much as it did me.

A few weeks ago, I finally received my custom made program, which quickly lets me analyze any period in history (for which data exist, of course) to see if a hedged approach using ETFs and/or no load funds would have made sense or not.

I’ve been mainly focusing on testing scenarios in this century since it offered us two devastating bear markets that have clearly demonstrated the short comings of just about all of the canned asset allocation approaches.

Since ETFs were not available for most of the period, I have substituted them with no load funds (or load waived funds). The goal was for me to see if and how my SimpleHedge approach would work when pitted against the S&P; 500 index by using an S&P; 500 no load mutual fund.

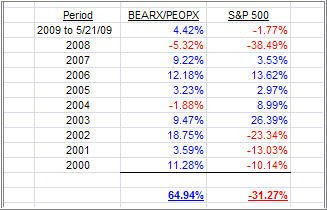

For the short side of the hedge, I selected BEARX, and on the long side I randomly picked PEOPX, both of which have data going back to 1996.

I ran the numbers to generate yearly returns, including reinvested dividends, and this is what I came up with:

I was pretty amazed when I saw those results. How is this possible? Simple. The key is NOT to buy-and-hold the hedge, but to rebalance it appropriately as described in my e-book.

Rebalancing is the key to all success when using my hedge approach since it locks in profits and minimizes losses. If you look at the numbers above, you’ll notice that the “feast or famine” type of investing so prevalent in buy-and-hold scenarios has been smoothed out. In this example, the returns are steady and while big drops are eliminated (2002/2008), so are big gains (2003).

However, as you can see, it is not necessary to have high gain years such as 2003, which are simply neutralized with the next downturn.

I am not saying that this is a scenario you should use; I am merely pointing out what can happen if you apply a hedge discipline over a period of time during which most investors and professionals lost when using the S&P; 500 as a benchmark.

I have no positions in this hedge, although I am using BEARX with other hedge combinations. I have found a number of hedges I am currently using that have produced twice the return of the above BEARX/PEOPX combination, which means that they are on par with returns that most investors only hope to get with straight long positions.

In my advisor practice, I use hedges along with outright long holdings depending on our trend tracking signals and have found this to be a great combination for most clients.

The point of all this is not to discard a hedge approach as something inferior. My work has shown that hedging can offer great upside potential with severely limited downside risk, which is what most (not all) investors are looking for.