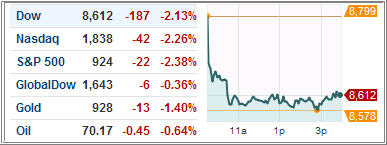

A variety of forces combined yesterday and pulled the major indexes off their highs.

A variety of forces combined yesterday and pulled the major indexes off their highs.

Some kind of a correction was long overdue with the markets having enjoyed an extended run. It remains to be seen, if this is the start of something prolonged.

Judging by the low volume, it does not appear that way but, nowadays, you need to be prepared for the fact that anything is possible. We may very well enter a period in which neither wild fear is coming back into the market nor unbridled enthusiasm.

Our Trend Tracking Indexes (TTIs) retreated and are hugging their respective trend lines as follows:

Domestic TTI: +0.86%

International TTI: +8.79%

Hedge TTI: +0.27%

All buys signals remains if effect subject to our trailing stop loss points.

Comments 1

A story, as of 5:00 p.m.,E.T., an article in WashingtonPost.com by Dan Balz and Jon Cohen, titled, Poll: Americans Poll: Americans Less Upbeat About Stimulus Bill's Impact," said "With unemployment projected to continue rising and fears that the big run-up in stock prices since February may have been a temporary trend, fixing the economy remains the most critical issue of Obama's presidency — and retaining public confidence in his policies is an important element of his recovery strategy." The story went on to say that while Obama's personal popularity remains high but the popularity of his recovery plan is fading and there is a lot of concern about the Federal deficit.

A lot of economists have said or written that high joblessness is a lagging indicator of the recovery, but it's another thing to tell that to the almost 10% of the population who don't have jobs and another high percentage who are employed only part-time (where it is impossible for me to determine, from the government's numbers if part-time employment is voluntary or not).

Anyway, it appears that a significant number of Americans are not only concerned about high unemployment figures but they are also concerned that the recent run-up in the stock market might be temporary. I have wondered a lot that this run-up might be temporary myself.

The link to the above-mentioned article is: http://www.washingtonpost.com/wp-dyn/content/article/2009/06/22/AR2009062202000.html?hpid=topnews⊂=AR&sid;=ST2009062202384