Ever since the FED “expanded its balance sheet,” investors have increasing become worried about the prospect of inflation. They have pored billions of dollars into TIPS and other funds in the hope that their portfolios will not succumb to the ravages of inflation—whenever it becomes a problem.

Ever since the FED “expanded its balance sheet,” investors have increasing become worried about the prospect of inflation. They have pored billions of dollars into TIPS and other funds in the hope that their portfolios will not succumb to the ravages of inflation—whenever it becomes a problem.

I am not so sure whether all of the alleged inflation hedges will actually perform as assumed and/or advertised. The WSJ questioned them as well in “Inflation Protection—No Guarantees:”

The threat of inflation is drifting through the collective consciousness of investors these days. But will the inflation-protection investments so many are turning to work as advertised?

…

Worried investors have been looking for insurance in the form of assets such as mutual funds and exchange-traded funds focused on gold, commodities and Treasury inflation-protected securities, or TIPS. In the past year, interest in TIPS funds in particular has been running at record levels, with some weeks recording more than $400 million in sales.

But many of these investments have never been tested during a bout of meaningful inflation. The last time inflation ramped up significantly was three decades ago. Yet TIPS have been around only since the late 1990s, and commodity funds are of even more recent vintage, as are the gold funds that invest in bullion or track the metal’s market price.

…

TIPS are designed to track changes in the monthly CPI, as reported by the Bureau of Labor Statistics. If the CPI rises, the securities’ principal, or face value, increases. That increases interest income for the holder—because the interest is set as a percentage of the principal—helping investors keep pace with rising prices. Plus, when the securities mature, investors get back the CPI-adjusted principal.

For many investors, TIPS appear to be the purest form of inflation protection, since they are the only asset explicitly tied to an inflation benchmark.

But that raises a key question: Does the CPI accurately reflect inflation? “No,” says Paul Brodsky, a partner at QB Asset Management. “The CPI is deeply flawed. It is not an accurate indication of how much purchasing power a dollar loses.”

The index, for instance, doesn’t reflect borrowing costs. When the Federal Reserve raises interest rates, rates on credit-card balances and other adjustable-rate loans rise, and consumers must spend more to pay off their debt or support a lifestyle funded with credit cards. And there are other quirks: When airlines lower prices, that is captured by the CPI, yet when they impose a $25 surcharge for luggage, that is not. Your own mix of expenses could also be very different from the one the benchmark uses.

So, in terms of both the interest payments and the principal returned, TIPS could disappoint investors expecting these securities to help them preserve their purchasing power.

Moreover, the market value of TIPS won’t necessarily perform as expected. That could lead to losses for investors who own TIPS directly and sell them before maturity, or for investors in TIPS funds.

Amid nascent inflation, TIPS prices would likely perform better than those of regular Treasurys, as investors rush to own inflation protection. Once the Fed responds by raising interest rates, however, TIPS already in the market would begin to lose some luster, just like regular Treasurys. After all, if a new TIPS offers a yield of, say, 5%, investors would have little interest in older securities yielding 3%. The market price of those older TIPS would fall, which could result in losses for investors who own them and decide to sell.

Of greater concern is what happens to TIPS if the market or the Fed is particularly aggressive in pushing up interest rates.

If this topic is of interest to you, I suggest you read the entire article, which covers gold and commodity funds as well.

Inflation is not a concern right now, while we are still entrenched in a deflationary environment with a sluggish economy, but eventually it will be. You can better prepare yourself by not just blindly hoping that your chosen anti-inflation investments will perform as assumed, but to also follow the trends.

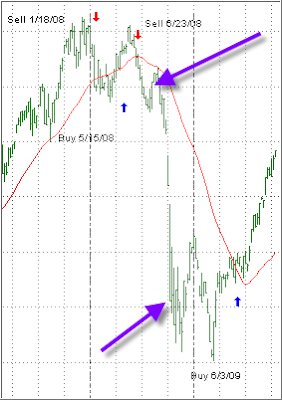

For example, if TIP all of a sudden starts to reverse direction sharply and heads south, use your trailing sell stop to exit. Afterwards, you can try to assess the reasons, but don’t become complacent thinking that you are prepared just because you hold an investment that allegedly protects you from inflationary forces.

I believe that we are entering un-chartered territory and no one can, with any certainty, tell you what you should be invested in. Use the long-term trends as your guide (via my weekly StatSheet) and let them tell you what areas you should deploy some of your portfolio dollars in.

You can further eliminate guess work and emotional decision making by establishing clearly defined entry and exit points, so you will be working from a blueprint ahead of time and not making decisions by the seat of your pants and/or when the (market) heat is on.

Disclosure: We currently have positions in TIP

Reader Mel has invested $1.1 million with 45% allocated to the domestic market, 30% to the international arena and 15% to bonds and other small holdings.

Reader Mel has invested $1.1 million with 45% allocated to the domestic market, 30% to the international arena and 15% to bonds and other small holdings.