Things are so much easier to evaluate with the benefit of hindsight. I was reminded of that when reader Jon sent in this comment:

If the TTI is so accurate, why don’t you short the market when it indicates a major downturn? Why stay on the sidelines when there is money to be made shorting the market, especially now that there are so many inverse ETFs?

It’s not the accuracy of the TTI that will solve all problems for you when intending to short the market; it’s the accompanying volatility that causes frustrations.

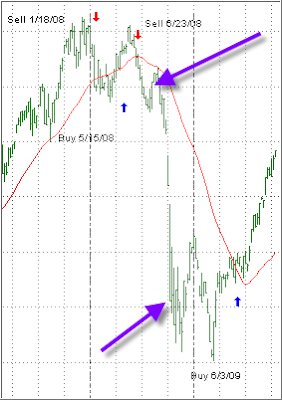

Take a look at the blown up chart of the Domestic Trend Tracking Index (TTI) reflecting on market behavior last year:

2008 started with a sell signal on January 18. If you had sold short at that time, you would have been stopped out fairly quickly as the trend reversed and generated another Buy on May 15, which lasted barely 5 weeks until the Sell on June 23.

Shorting again at that time, would have produced another whip-saw, as a rally (upper purple arrow) would have triggered your sell stop again. Sure, the ensuing free wall would have been very profitable but with a sell stop in place, you had no chance to participate.

After the bottom was hit (lower purple arrow), any aggressive shorting during those volatile times would have produced a series of discouraging whip-saws. I know some of clients who attempted such heroics with their “play” accounts, without much success.

The point is, just because many more tools are now available for shorting the market does not mean it’s wise to do so. Personally, I am content with the fact that the TTI gave us a signal to move to the safety of the sidelines, which millions of investors wish they had participated in.

Even after this year’s tremendous rebound, those that followed signal of the TTI are still ahead, since the S&P; 500 will need to gain another +17.5% from Friday’s close just to reach the level of our sell signal on 6/23/08.

As the last 20 years have shown, the TTI is a great tool to use when trying to identify changes in market direction. However, when we are entering bear market territory, volatility usually increases dramatically and may make shorting, along with the use sell stops, an endeavor only suitable for the most aggressive of investors.

Comments 2

How wide a range would have been necessary to have not been stopped out of a short position? I seems that if there is too close a stop loss in a volatile market, it will be stopped out. How about giving it more room?

Anon,

I don't know and it does not matter because next time the circumstances will be different. There is no such thing as successful curve fitting to try to optimize a sell stop.

You simply have to take your chance.

Ulli…