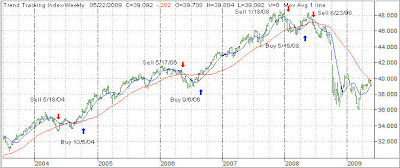

While my main day-to-day focus is on the use of a disciplined investment strategy via trend tracking, it pays to look at the big picture every so often to see where we stand economically and to assess the effects of the financial bailouts.

While my main day-to-day focus is on the use of a disciplined investment strategy via trend tracking, it pays to look at the big picture every so often to see where we stand economically and to assess the effects of the financial bailouts.

Other bloggers are more qualified to talk on that subject, and I like to reference articles that mince no words, have no bias and simply want to tell it as it is. This week’s hat tip goes to Dr. Housing Bubble, who reviews some facts of the trillions of bailout money, which have been flushed down the ever growing sink hole.

Here are some snippets, but I encourage you to read the entire article so you can better view the enlightening charts and graphs:

Banks, take the blue pill. Public, please take the red pill. If I had to characterize the current economic environment, it would have to consist of two completely different sets of beliefs.

On one hand, you have banks and Wall Street receiving massive bailouts from the U.S. Treasury and the Federal Reserve, bailouts of the magnitude that would gear up for a Great Depression and imply that the banking system of our country is insolvent.

Then on the other hand, you have Wall Street and the crony banks trying to convince the public that this is a minor recession and all will be well in Q3 and Q4 of 2009. The problem of course is that this is not your typical recession yet the public is being led to believe that all is well while bailouts are being dolled out by the truckload to the wrong locations. The actions we are taking keeps in place the banking oligarchy and sacrifices the public under the guise that this is good medicine for the general economy.

…

The latest housing data shows that nationwide we have just shattered all records for monthly foreclosure filings in one month. Foreclosures are moving higher and higher. We are now approaching the 2-year anniversary of this housing and credit crisis yet the core issue of housing is still not being dealt with. What we are doing is bailing out banks while the public is left to deal with the fallout. The hypocrisy is creating deep anger, as it should. When TARP 1 came out, banks were given the first $350 billion with no questions asked. That money of course has been squandered. However, when it comes to modifying the mortgage of struggling homeowners, banks conveniently find every excuse to avoid reworking the mortgage. And when I say reworking, I mean cutting the principal down not extending the term out to 40 years or cutting the interest rate by a point. This is their idea of working with the public.

The foreclosure chart above tells us one thing. We are not helping the public. We are not solving the housing crisis. The notion that bailing out banks would somehow trickle down to the public is absurd. How many issues of systemic failure did we deal with? AIG? Fannie Mae and Freddie Mac? Lehman Brothers? The list goes on and on. With the AIG bailout, we used systemic failure as the premise to funnel money through the firm as a conduit to Wall Street firms like Goldman Sachs. Can’t allow them to lose a penny because that would be systemic.

And by the way, do you remember those estimates last year that the GSE bailout was actually going to give us a profit in the long run or at worst, cost us $25 billion?

“(WaPo) The Obama administration has clarified what it expects the takeover of Fannie Mae and Freddie Mac to cost taxpayers: $171.1 billion.”

Whoops! Missed by a few hundred billion there. Yet someone that lost their job and lost their home has already faced systemic failure. We have in our country nearly 25,000,000 unemployed or underemployed Americans. And somehow, the market is shocked that retail sales contracted? Of course it contracted. The public doesn’t have an unlimited credit card to the Federal Reserve and U.S. Treasury like the banks and Wall Street. Ironically, it is the public that is now paying for the mess with no benefit at all. We have now committed over $13 trillion in bailouts, almost one year of our nationwide GDP.

…

If you look at the record number of foreclosures and defaults, banks are doing the right thing (according to their balance sheets). They are operating for their own survival. But that wasn’t how the bailouts were presented. Can you imagine if they told the public the real reason for the bailouts,

“Hi everyone. We are going to need to commit trillions of your dollars to bailout a banking system that failed you. A system that didn’t exercise due diligence. A structure that fueled the housing bubble. What will you get in return? You get to keep us going. The system that failed you appreciates your support.”

What the public was told is that these bailouts were required to keep lending going and to ameliorate the housing situation.

…

So where do we stand today? We have a crucial choice to make here. Do we want to make banking a utility like industry or bailout Wall Street and banks so they can go back to the global financial casino? So far, the path we are taking is keeping the casino alive. The issue of course is to find people at the levers of power in the government who are not soiled by banking industry money.

This is a challenge and that is why trillions in bailouts are going to banks and Wall Street while the public gets the shaft. $100 to the banks, $1 for you. At times, I sit back and wonder why the public isn’t in a bigger uproar? Are they not angry that their money is going to bailout a crony oligarch banking system? Then I remember those times in college where I would hear peers say, “I hate math, don’t want to deal with it ever again.” Therein lies the problem. Very few in the public really understand what is going on. How many times have you seen CNN, MSNBC, Fox, or even CNBC go in depth about the Federal Reserve? I’ll leave you with a quote from Henry Ford:

“It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.”

While we don’t control any of these facts, it’s important to be aware of them for the simple reason that they control and influence market direction. This “disconnect” between Wall Street and Main Street has been obvious over the past few weeks as the rebound rally neglected facts in favor of hope.

Being disciplined with your investing endeavors is the only way to survive once Wall Street gets hit with a dose of reality, whenever that will be.