Selecting individual country funds for your portfolio can be a challenge due to the above average volatility. Additionally, you’ll never know when one country’s bull market run suddenly peters out while another one continues to scale to new highs.

A better and more conservative way is to use an ETF which covers an entire region such as emerging markets (EEM). While you’re spreading your dollars over a larger area and limiting your gains, you’re also reducing your risk considerably.

For example, everybody would have liked to be participating in the China bull market last year, but many missed that boat including me. Not that I didn’t see the strong momentum numbers develop, I just didn’t like the risk.

But there are still ways to participate more conservatively in regions with great current and future promise called the BRIC countries (Brazil, Russia, India and China). While you can buy an individual country ETF for each of those, you can also buy the entire BRIC community with one ETF called EEB.

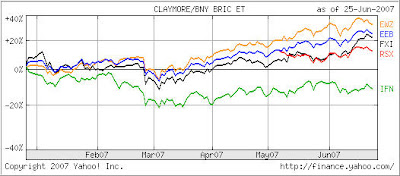

Take a look at the following 6-months chart, which shows the EEB performance compared to all other BRIC members:

The advantage of using EEB vs. individual ETFs becomes clear as we’re dealing here with countries of extreme volatility. Leading the pack, you have Brazil (EWZ) as the top performer smoothing out a sub par performance by India (IFN) while Russia (RSX) and China (FXI) are sitting below EEB performance wise.

This is not meant to be a green light for you to jump in with your portfolio, it merely points out another investment option that you may not have been aware of.

I currently have no invested position in the BRIC region but that may change in the future.