- Moving the markets

The markets predominantly trod water after the S&P’s fresh record close, with traders’ eyes now focused on tomorrow’s jobs report.

Friday’s non-farm payrolls report for May will be analyzed carefully, because any weakness in the labor force will freshen hopes that the Fed might indeed cut rates. Expectations are for 190k in new jobs created.

Optimism prevails on Wall Street that the economy is still doing well, despite much evidence to the contrary. A cooling job market will be hard to reverse once it starts, which is why traders believe a rate cut is on the horizon.

More pressure will be on the Fed after the Bank of Canada cut rates by a measly 0.25%, which was followed this morning by the ECB. That tiny reduction appears to be more like a market pleasing goodwill gesture rather than a serious effort. Remember, all Central Banks are walking a tightrope, because lowering rates to save failing economies will stoke inflationary fires.

Tech darling Nvidia’s upward momentum got crushed during this session, with the company losing some $175 billion in market cap. Gold and silver picked up on the BoC and ECB rate reductions and continued their upward swing.

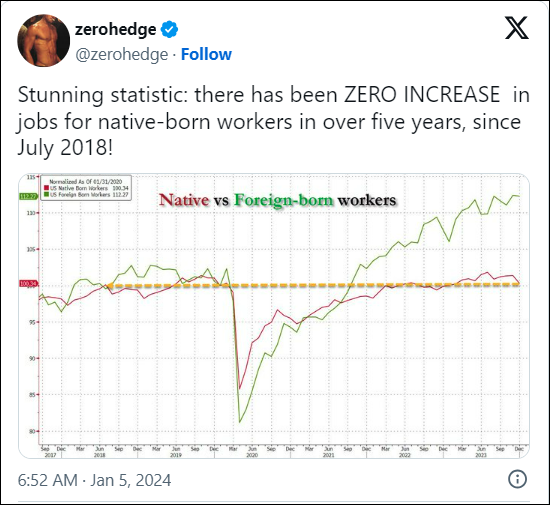

In terms of the US Labor market, which has been horrendously weak, it was now confirmed what ZeroHedge pointed to a more than a year ago, namely that all the job growth in the past few years—drumroll—has gone to illegal aliens.

I leave it up to you to ponder this chart and arrive at your own conclusions:

Continue reading…

2. Current “Buy” Cycles (effective 11/21/2023)

Our Trend Tracking Indexes (TTIs) have both crossed their trend lines with enough strength to trigger new “Buy” signals. That means, Tuesday, 11/21/2023, was the official date for these signals.

If you want to follow our strategy, you should first decide how much you want to invest based on your risk tolerance (percentage of allocation). Then, you should check my Thursday StatSheet and Saturday’s “ETFs on the Cutline” report for suitable ETFs to buy.

3. Trend Tracking Indexes (TTIs)

The ECB followed in the Bank of Canada’s footsteps and lowered its main interest rate by 0.25% as well. The major indexes traded sideways, with tomorrow’s potentially market moving jobs report lurking on deck.

Our TTIs offered a mixed picture, as the international one advanced, while the domestic one slipped slightly.

This is how we closed 06/06/2024:

Domestic TTI: +6.88% above its M/A (prior close +7.08%)—Buy signal effective 11/21/2023.

International TTI: +9.29% above its M/A (prior close +8.89%)—Buy signal effective 11/21/2023.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli