- Moving the markets

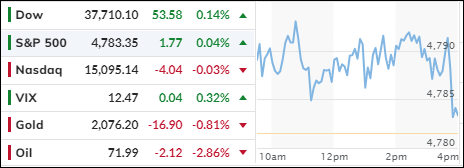

The S&P 500 barely budged today, but it was enough to inch closer to a new record high. Wall Street is hoping to end 2023 with a bang, after a stellar fourth quarter that erased the losses of the previous one.

The S&P is up 11.7% for the quarter, its best performance in three years, and the three major indexes are on track to post their ninth consecutive weekly gains.

But not everything is rosy in the market. Traders are betting on rate cuts and lower inflation in 2024, which may turn out to be wishful thinking. Today’s economic data was disappointing, with lower inventories, higher jobless claims, and weaker home sales.

The market was mixed, with small caps, cryptos, and oil losing ground, while the dollar, the Dow, and bonds yields rose. The Mag7 stocks managed to squeeze out a positive close, but junk bonds diverged from the S&P 500. Gold briefly hit $2,088 overnight, but couldn’t keep the momentum, as oil dropped below $72 and closed at its lowest in a week.

Some analysts are warning of a possible correction, especially if the S&P reaches $4,900. How deep and how long is anyone’s guess, but one thing is certain: volatility is waiting in the wings, ready to pounce. Will the market end the year with a whimper or a bang? Tune in tomorrow to find out.

2. Current “Buy” Cycles (effective 11/21/2023)

Our Trend Tracking Indexes (TTIs) have both crossed their trend lines with enough strength to trigger new “Buy” signals. That means, Tuesday, 11/21/2023, was the official date for these signals.

If you want to follow our strategy, you should first decide how much you want to invest based on your risk tolerance (percentage of allocation). Then, you should check my Thursday StatSheet and Saturday’s “ETFs on the Cutline” report for suitable ETFs to buy.

3. Trend Tracking Indexes (TTIs)

The market was calm and steady on the penultimate trading day of 2023, with little change in the indexes or the trading activity.

Our TTIs showed minor fluctuations but still indicate a bullish outlook for the market.

This is how we closed 12/28/2023:

Domestic TTI: +9.25% above its M/A (prior close +9.08%)—Buy signal effective 11/21/2023.

International TTI: +7.60% above its M/A (prior close +7.68%)—Buy signal effective 11/21/2023.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

Contact Ulli