- Moving the markets

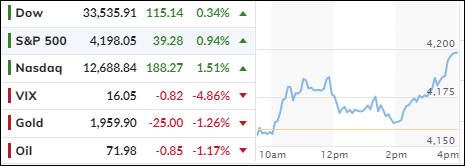

The stock market had a strong finish on Wednesday, overcoming a sluggish start and a midday dip. The S&P 500 turned positive for the month, while the Dow trailed behind the Nasdaq. The rally was fueled by optimism about a debt ceiling deal, as House Speaker McCarthy signaled progress in talks with President Biden.

However, not everything was rosy on Wall Street. The Fed officials sounded hawkish, warning that inflation was too high and that rate hikes were still on the table. The bond market took notice, sending yields higher and hurting gold prices. The economic data was also mixed, with weak indicators for housing and business activity, but strong numbers for jobless claims and Walmart earnings.

The Nasdaq seemed to ignore the rising bond yields, which usually weigh on growth stocks. This divergence could spell trouble down the road, as one of them will have to adjust to reality. Will the tech-heavy index fall or will the 10-year rate rise?

Stay tuned for the next episode of “The Market vs. The Fed”.

2. “Buy” Cycle Suggestions

For the current Buy cycle, which started on 12/1/2022, I suggested you reference my then current StatSheet for ETF selections. However, if you came on board later, you may want to look at the most recent version, which is published and posted every Thursday at 6:30 pm PST.

I also recommend you consider your risk tolerance when making your selections by dropping down more towards the middle of the M-Index rankings, should you tend to be more risk adverse. Likewise, a partial initial exposure to the markets, say 33% to start with, will reduce your risk in case of a sudden directional turnaround.

We are living in times of great uncertainty, with economic fundamentals steadily deteriorating, which will eventually affect earnings negatively and, by association, stock prices.

In my advisor’s practice, we are therefore looking for limited exposure in value, some growth and dividend ETFs. Of course, gold has been a core holding for a long time.

With all investments, I recommend the use of a trailing sell stop in the range of 8-12% to limit your downside risk.

3. Trend Tracking Indexes (TTIs)

Our TTIs gained again as the markets, led by the Nasdaq, maintained upward momentum.

This is how we closed 05/18/2023:

Domestic TTI: +0.97% above its M/A (prior close +0.16%)—Buy signal effective 12/1/2022.

International TTI: +5.90% above its M/A (prior close +5.50%)—Buy signal effective 12/1/2022.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

Contact Ulli