ETF Tracker StatSheet

You can view the latest version here.

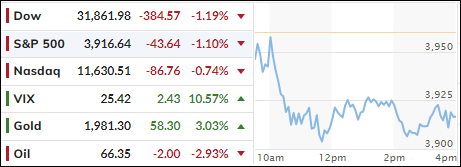

ENDING A ROLLERCOASTER WEEK WITH A NOSEDIVE

- Moving the markets

The state of the US Banking sector remains precarious, as confidence has not been restored causing the major indexes to take another dive. Maybe traders finally got the idea that, not just covering $250K of depositor’s money in a failed bank, but to make everybody whole, has unintended consequences.

After all, there are some $30 trillion deposits lingering in US banks. Does that mean, with the FDIC apparently having been pushed aside and/or put out of business, that the Fed will now cover the full monte? If so, batten down the hatches, because the subsequent inflationary impact will make your head spin.

So much for my rant…

First Republic bank took another hit and dumped 32% bringing the total loss for the week to more than 70%. Looking at the bigger picture, the Regional Banking ETF (KRE) slid 6% today and is down 14% for the week.

The latest banking cockroach on deck, Credit Suisse, was down some 5% despite its promised $54 billion lifeline from Swiss National Bank. Hmm…

As I said before, these are just the first dominos to fall, since every bank is in a similar situation of sitting on big losses in their long-term bond portfolios, which got clobbered, as the Fed went on its interest hiking spree. As demand for withdrawals increases, such upside-down holdings need to be liquidated at any cost, as was the case with SVB.

Energy and Financials were the weaklings of the week, while office REITS got slaughtered as did European bond yields. It seems that something has broken somewhere in the financial system, with worldwide impact, as even the US Dollar closed lower for the week.

This was confirmed by smart money moving into Gold, with the precious metal adding another 3% for the day. It has now reached its highest level since April 2022 and is closing in on the $2k level.

Today, we saw options expiring and, with that uncertainty out of the way, we may see a rebound next week, at least until the Fed meets on Wednesday and regales us with their latest wisdom on interest rates. That will determine if the bulls can win this current tug-of-war against the bears.

2. “Buy” Cycle Suggestions

For the current Buy cycle, which started on 12/1/2022, I suggested you reference my then current StatSheet for ETF selections. However, if you came on board later, you may want to look at the most recent version, which is published and posted every Thursday at 6:30 pm PST.

I also recommend for you to consider your risk tolerance when making your selections by dropping down more towards the middle of the M-Index rankings, should you tend to be more risk adverse. Likewise, a partial initial exposure to the markets, say 33% to start with, will reduce your risk in case of a sudden directional turnaround.

We are living in times of great uncertainty, with economic fundamentals steadily deteriorating, which will eventually affect earnings negatively and, by association, stock prices. I can see this current Buy signal to be short lived, say to the end of the year, and would not be surprised if it ends at some point in January.

In my advisor practice, we are therefore looking for limited exposure in value, some growth and dividend ETFs. Of course, gold has been a core holding for a long time.

With all investments, I recommend the use of a trailing sell stop in the range of 8-12% to limit your downside risk.

3. Trend Tracking Indexes (TTIs)

Our TTIs rode the roller coaster as well, with the Domestic one coming close to breaking back above its dividing line between bullish and bearish territory. We are still in the neutral zone but have reduced our equity exposure dramatically, as I posted.

This is how we closed 03/17/2023:

Domestic TTI: -2.65% below its M/A (prior close -0.82%)—Buy signal effective 12/1/2022.

International TTI: +1.84% above its M/A (prior close +2.73%)—Buy signal effective 12/1/2022.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli