- Moving the markets

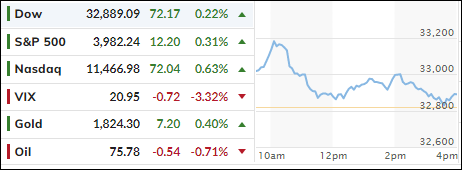

Last week’s thrashing of the markets was the worst so far in 2023. So, it comes as no surprise that traders and algos engaged in some bottom fishing with another big week in retail earnings hopefully proving the support to give these efforts some staying power.

While the early thrust petered out, at least the major indexes were able to close out the session with moderate gains. The recent spike in bond yields, with the 10-year kissing its 4% level, created a risk-off scenario, but today’s slight pullback helped yet gave only limited support to equities.

The economic data bag was mixed, and we learned that US Pending Home Sales exploded higher in January, but the Dallas Fed Manufacturing Production index plunged into contraction, dipping to -13.5 from -8.4. Following that same meme were Durable Goods Orders, which plummeted the most since April 2020. Ouch!

Bucking the trend, and providing more evidence that a Fed pause or pivot is nowhere near in sight, was the Citi Economic Surprise Index, which ratcheted higher—again. Consequently, the Fed’s terminal rate inched up towards the 5.5% level, while rate cut expectations were non-existent, which means hopes of a dovish Fed response have been dashed.

As ZeroHedge pointed out, the ever-present short squeeze has now failed for the 4th day in a row, confirming the continued tug-of-war between bulls and bears with the S&P’s 4k level being the much sought after price, along with the 200-day M/A, which currently sits at 3,940. If violated, it could trigger some $50 billion of selling by the big boys, who use that level as guiding point for getting out of long positions and establishing short ones.

With the US Dollar weakening, Gold finally managed to rebound off its recent lows.

2. “Buy” Cycle Suggestions

For the current Buy cycle, which started on 12/1/2022, I suggested you reference my then current StatSheet for ETF selections. However, if you came on board later, you may want to look at the most recent version, which is published and posted every Thursday at 6:30 pm PST.

I also recommend for you to consider your risk tolerance when making your selections by dropping down more towards the middle of the M-Index rankings, should you tend to be more risk adverse. Likewise, a partial initial exposure to the markets, say 33% to start with, will reduce your risk in case of a sudden directional turnaround.

We are living in times of great uncertainty, with economic fundamentals steadily deteriorating, which will eventually affect earnings negatively and, by association, stock prices. I can see this current Buy signal to be short lived, say to the end of the year, and would not be surprised if it ends at some point in January.

In my advisor practice, we are therefore looking for limited exposure in value, some growth and dividend ETFs. Of course, gold has been a core holding for a long time.

With all investments, I recommend the use of a trailing sell stop in the range of 8-12% to limit your downside risk.

3. Trend Tracking Indexes (TTIs)

Our TTIs finally rebounded modestly, as uncertainty about the direction of interest rates kept a lid on advances.

This is how we closed 02/27/2023:

Domestic TTI: +3.96% above its M/A (prior close +3.83%)—Buy signal effective 12/1/2022.

International TTI: +7.06% above its M/A (prior close +6.25%)—Buy signal effective 12/1/2022.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

Contact Ulli