- Moving the markets

While we saw a benign opening, things went south for the broad markets, as Monday’s theme of climbing a wall of worry was short lived with the major indexes giving back more than they gained yesterday. It brought back of thoughts as to whether this chart indeed is showing a topping formation.

Downward momentum accelerated in the last hour when Fed mouthpiece Brainard, a more dovish Fed member, opined that a more aggressive approach to the Central Bank’s policies might be in order.

Mark Zandi, chief economist at Moody’s Analytics, assessed the situation with much realism:

“Ultimately, the way this is going to work, the economy is going to slow, the stock market has to reflect that. So, I do expect the stock market to have a tough few months here as it ultimately adjusts to what the Fed is doing and will do going forward.”

That view went right along with Deutsche Bank’s statement forecasting a recession ahead, the first major Wall Street bank to do so.

Bond yields exploded to the upside with the 10-year adding 15 bps to end the session at 2.555%. Ouch! That crushed bond holders again with the widely held TLT getting clobbered at the tune of -2.26% bringing its YTD loss to -11.29%. We have now reached the highest yields since 2018.

“Value” outperformed “growth” and yesterday’s market savior, namely the seemingly ever-present short squeeze, was absent today giving the “most shorted stocks” an opportunity to do what they do best: go lower.

The US Dollar headed higher, causing Gold to dip moderately.

In the end, ZH summed it up well by questioning the validity of this recent rally in the face of 9 more rate hikes this year. Graphically, it looks like this.

Hmm…

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

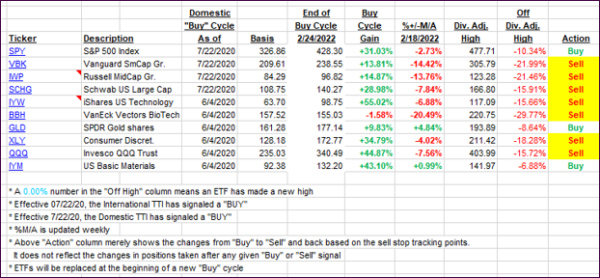

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this just closed-out domestic “Buy” cycle, here’s how some of our candidates have fared:

Click image to enlarge.

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -12% point has been taken out in the “Off High” column, which has replaced the prior -8% to -10% limits.

3. Trend Tracking Indexes (TTIs)

Our TTI’s were pulled off their lofty levels in just one session. That’s why I have been holding off signaling a new “Buy.” Today’s sharp pullback validated that decision, and I will continue to look for more upside stability before changing my mind.

The current TTI numbers below support that view in that it may take only one more sell off session to push us back into bearish territory.

This is how we closed 04/05/2022:

Domestic TTI: +1.85% above its M/A (prior close +2.95%)—Sell signal effective 02/24/2022.

International TTI: +0.02% above its M/A (prior close +1.18%)—Sell signal effective 03/08/2022.

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

Contact Ulli