ETF Tracker StatSheet

You can view the latest version here.

EKING OUT ANOTHER WIN

- Moving the markets

All eyes were focused on today’s jobs report, which turned out to be a huge disappointment with only 235k jobs being added during August, a far cry from the expected 725k. As Zero Hedge explained, this number was not only a huge drop to last month’s upward revised 1.053 million but was the weakest print since January.

The markets took it in stride, with traders most likely thinking that the immediate danger of the Fed’s taper talk may have been put on the back burner.

Federal Reserve Chairman Jerome Powell has emphasized the need for more strong jobs data before the central bank would start to unwind its massive bond-buying program, and the disappointing report could change expectations about when the Fed will start its tapering process.

As a result, the major indexes climbed out of an early hole led by the Nasdaq, which closed moderately in the green, while the Dow and S&P 500 ended the session with tiny losses.

The dismal payroll report caused the US Dollar to collapse with Gold heading the other way by adding a solid +1.01% gain. A lack of confidence in the Central Bank seems to have been the main driver for the precious metal, which rallied in the face of spiking bond yields with 10-year closing above 1.32%.

The US economic surprise data dropped to its worst point since the plunge in March of 2020, as Bloomberg demonstrates here. This adds more power to my argument that the alleged economic recovery was merely a function of the magnitude and frequency of the “stimmie” checks and not based on organic economic fundamental growth.

In the end, none of it mattered, as the S&P 500 closed with another winning weak, though with only a small gain, but a win is a win.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can 8 again.

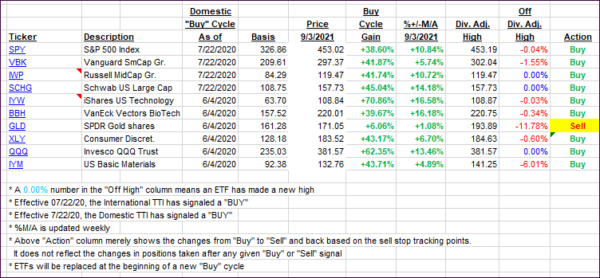

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge.

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs retreated as the broad market moderately slipped.

This is how we closed 09/03/2021:

Domestic TTI: +9.74% above its M/A (prior close +10.72%)—Buy signal effective 07/22/2020.

International TTI: +6.09% above its M/A (prior close +6.59%)—Buy signals effective 07/22/2020.

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

Contact Ulli