ETF Tracker StatSheet

You can view the latest version here.

WHEN GOOD NEWS IS BAD NEWS—OR MAYBE NOT?

- Moving the markets

Another wild ride in the markets turned out to be positive, after an early pump was followed by a huge dump, which then formed the base to be a springboard for the ramp into the close.

The early slam was the result of a better-than-expected improvement in the labor markets with the unemployment rate dipping to 6.2% and payrolls gaining 379k (good news), which is not what traders wanted to see. This news sent bond yields surging, with the 10-year spiking above the 1.60% level.

That in turn sent the US Dollar index sharply higher and triggered massive selling in stocks with the Nasdaq leading the way to the downside. One of our more volatile holdings, which had triggered its trailing sell stop yesterday, was liquidated, and will be replaced next week.

Our newly added SmallCap value ETF performed exceptionally well by adding +2.76%, thereby outperforming its “growth” cousin by a wide margin.

Easing bond yields around mid-session, with 10-year dropping to 1.56%, was enough of a motivator to drive the markets back up with all 3 major indexes ending the day close to their highs. Given the low level the Nasdaq had fallen to, it was its biggest intraday comeback in over a year.

Added ZH:

Today was utter chaos – just look at the swings in small caps! From +2% pre-open, to down 2.5% as SHTF, and back up to gains over 2% into the close…

The swings today were very technical nature – S&P ripped back up to test its 50DMA from below, Nasdaq bounced off its 100DMA, Dow bounced off its 50DMA, and Small Caps ripped back up above their 50DMA intraday…

Volatility exploded this week causing wild swings in all asset classes, in part due to Fed head Powell’s not very encouraging comments that that the economy sees “transitory increases in inflation…I expect that we will be patient.”

Hmm, makes me wonder if that type of meaningless jawboning will be enough to keep the markets calm and elevated.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

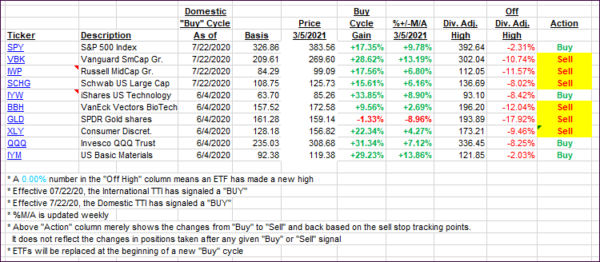

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge.

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs bounced back as today’s roller coaster ride ended to the upside.

This is how we closed 3/5/2021:

Domestic TTI: +17.44% above its M/A (prior close +15.54%)—Buy signal effective 07/22/2020.

International TTI: +16.09% above its M/A (prior close +15.94%)—Buy signals effective 07/22/2020.

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

———————————————————

Back issues of the ETF Tracker are available on the web.

Contact Ulli