ETF Tracker StatSheet

You can view the latest version here.

AN EARLY RALLY BITES THE DUST—AGAIN

- Moving the markets

Today resembled just how the week went for the major indexes. Early rallies lost steam, and this session was no exception, with the indexes ending the day at their respective unchanged lines. Overall, the pullback was modest with the S&P 500 surrendering -0.71% since last Friday.

A mix of rising interest rates (higher inflation), and some profit taking in the tech sector, dampened early enthusiasm and turned this session into a non-event. Bucking the pullback were SmallCaps (IWO), which catapulted higher by +2.08%, with MidCaps (IWP) joining in by rising +0.71%. Even Gold (GLD) withstood higher bond yields and added +0.42%.

CNBC chimed in like this:

The strength among economically sensitive stocks came after Treasury Secretary Janet Yellen told CNBC Thursday after the bell that more stimulus is necessary even as some economic data suggested a rebound is already underway. She added a $1.9 trillion stimulus deal could help the U.S. get back to full employment in a year.

The direction of bond yields will be the key component affecting the stock market trend. The 10-year Treasury yield rose to the highest in almost a year, and today added another 5 basis points to 1.34%. Some analysts think that if the 1.50% level is breached, this equity bull run will be in serious jeopardy.

One look at this chart shows what happened to the S&P 500 last time yields rocketed higher. This graph (ZH/Bloomberg) demonstrates that 30-year yields have surged the most since March 2020.

For sure, we will see an increase in volatility next week, as options expirations are on deck, an event that can spook markets and create uncertainty about future direction. Of course, should that happen, rest assured that the powers to be (Fed) will step in to placate the nervous nellies to restore calm, order, and bullishness.

And that sums up the kind of environment we are in.

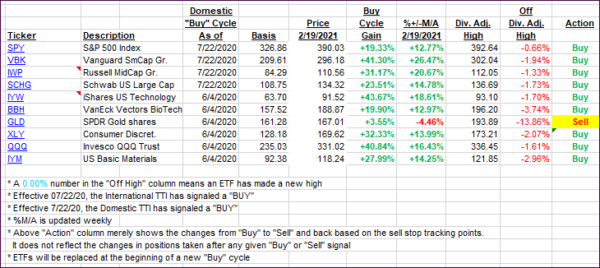

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge.

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs changed only slightly as the markets remained stuck at their unchanged lines.

This is how we closed 2/19/2021:

Domestic TTI: +17.81% above its M/A (prior close +17.99%)—Buy signal effective 07/22/2020.

International TTI: +17.41% above its M/A (prior close +18.02%)—Buy signal effective 07/22/2020.

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

———————————————————

Back issues of the ETF Tracker are available on the web.

Contact Ulli