ETF Tracker StatSheet

You can view the latest version here.

Preserving The Bullish Trend

- Moving the markets

Yesterday, I talked about rising bond yields to be a potential equalizer to future market direction, and we saw some of it today.

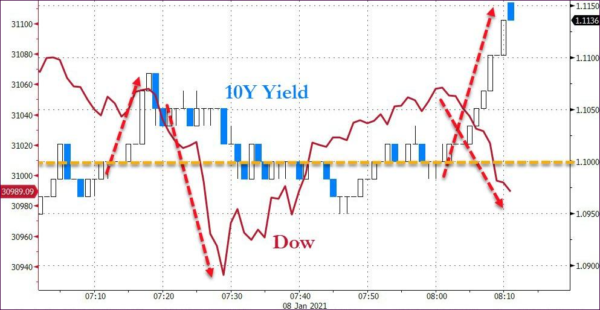

Stocks broke down a couple of times this morning, as the 10-year yield surged twice and pulled the Dow off its lofty level, as Bloomberg points to in this chart:

This is important and ZH elaborated as follows:

As we noted previously, if and when CTAs turn from sellers to outright shorters, accelerating the downward momentum in the 10Y price (and spike in yield), it may turn ugly fast, because as Morgan Stanley explained yesterday, while a slow push higher in the 10Y yield won’t affect risk assets materially, “should that adjustment in rates occur more rapidly, all stock prices will adjust lower, perhaps sharply, rather than just go sideways.”

While that is a future likelihood, at least today, a late afternoon ramp pulled the major indexes out of the red and to a green close. Contributing to this rebound were headlines from Joe Biden’s speech promising these goodies, which represent a fiscal bonanza:

*BIDEN: GAP IN BLACK, LATINO UNEMPLOYMENT IS `MUCH TOO LARGE’

*BIDEN: NEED RELIEF FOR WORKING FAMILIES, BUSINESSES NOW

*BIDEN: WILL LAY OUT FRAMEWORK FOR NEXT RELIEF PACKAGE NEXT WEEK

*BIDEN: VACCINE DISTRIBUTION IS GREATEST OPERATIONAL CHALLENGE

*BIDEN SAYS $600 RELIEF PAYMENTS AREN’T ENOUGH

*BIDEN: HOPE DEMOCRATIC CONGRESS CONTROL LEADS TO MIN WAGE BOOST

*BIDEN: AMERICANS ENTITLED TO $15/HOUR MINIMUM WAGE

*BIDEN: BLACK, BROWN-OWNED BUSINESS HAVE HAD LESS RELIEF ACCESS

*BIDEN: TENS OF THOUSANDS OF COS. GOT RELIEF THEY SHOULDN’T HAVE

*BIDEN: FOCUS TO BE ON SMALL BIZ WITHOUT CONNECTIONS

*BIDEN: WILL DIRECT RELIEF TO THOSE INDUSTRIES HIT THE HARDEST

*BIDEN: WILL HAVE NAVIGATORS TO HELP SMALL BIZ UNDERSTAND RELIEF

*BIDEN: WILL MAKE BANK EXPECTATIONS `CRYSTAL CLEAR’

That was all it took to restore bullish confidence, and up we went. The leader again, was the Nasdaq with a solid +1.03% gain, for a change outperforming Small- and MidCaps.

On the economic front, we learned that December Payrolls missed by a huge margin. It’s hard to believe, but 140,000 jobs were lost on expectations of a 50k gain. This is the worst month since April’s record drop.

You would think that a number like this would have decimated the stock market, but as I have repeatedly pounced on, the economy and stock markets are in no way related.

It’s all about monetary and fiscal stimulus, and with the Fed announcing “no taper” anytime soon, markets appear to be ready to reach for the next all-time high.

Gold got smacked today, giving back its hard-fought gains from earlier in the week, as the US Dollar rallied on higher bond yields.

Again, bond yields are the pivotal sector to watch, because a continued spike will affect equities negatively at some point.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

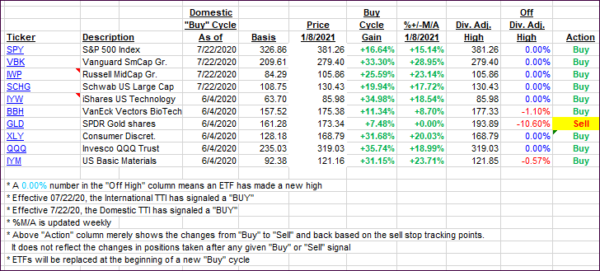

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge.

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs came off their highs, despite the indexes maintaining their bullish stance.

This is how we closed 1/08/2021:

Domestic TTI: +20.50% above its M/A (prior close +21.46%)—Buy signal effective 07/22/2020.

International TTI: +19.90% above its M/A (prior close +20.65%)—Buy signal effective 07/22/2020.

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

———————————————————

Back issues of the ETF Tracker are available on the web.

Contact Ulli