- Moving the markets

Again, the futures pointed to a positive beginning in the cash markets, and that’s exactly how it opened. While the major indexes spiked early on, they faded throughout the session but managed to close in the green, though by a only small margin.

After the drubbing of the past couple of days, SmallCaps found renewed momentum and surged +1.15% outperforming the major indexes. Vaccine optimism and additional stimulus was the driving force to higher prices.

The stimulus saga continues full force with CNBC calling it this way:

The Senate currently has no plans to vote on a bill that would increase checks to $2,000 from $600. That measure was passed by the House late Monday. However, Senate Majority Leader Mitch McConnell introduced another bill that ties the increased payments to demands from President Donald Trump on tech and the election.

The US Dollar took another hit and continued its race to the bottom, wherever that might be, in the process giving an assist to gold, which rallied +0.78% but fell short of reaching its $1,900 level.

If you are a follower of the financial news, you undoubtedly will have come across the jargon the professionals use, but you may not have been clear on its true meaning. One investment chief allowed the Institutional Investor to publish it under the heading:

“Asset Managers BS—Decoded,” presented tongue in cheek.

- Now is a good entry point = Sorry, we are in a drawdown

- We have a high Sharpe ratio = We don’t make much money

- We have never lost money = We have never made money

- We have a great back test = We are going to lose money after we take your money

- We have a proprietary sourcing approach = We invest in whatever our hedge fund friends do

- We are not in crowded positions = We missed all the best-performing stocks

- We are not correlated = We are underperforming while the market keeps going up

- We invest in unique uncorrelated assets = We have an illiquid portfolio which can’t be valued and will suspend soon

- We are soft closing the fund = We want to raise as much money as we can right now

- We are hard closing the fund = We are definitely open for you

- We are not responsible for the bad track record at our prior firm = We lost money but are blaming all our ex-colleagues

- We have a bottom-up approach = We have no idea what markets are going to do

- We have a top-down process = We think we know what markets will do but really who does?

- The markets had a temporary mark-to-market loss = Our fundamental analysis was wrong, and we don’t know why we lost money

- We don’t believe in stop-loss limits = We have no risk management

Tomorrow’s last session of 2020 will be an abbreviated one, and I will not write a commentary. Just like you, I will enjoy some time off and will return on Monday refreshed and eager to deal with next year’s issues.

Happy New Year!

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

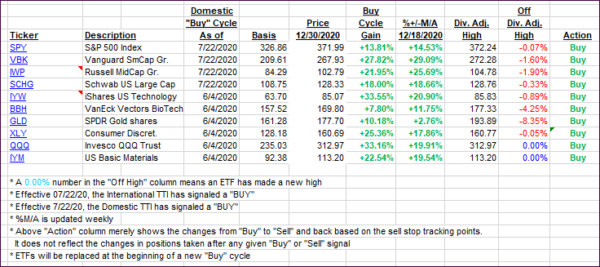

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs pulled back despite the major indexes eking out small gains.

This is how we closed 12/30/2020:

Domestic TTI: +17.42% above its M/A (prior close +18.76%)—Buy signal effective 07/22/2020

International TTI: +16.66% above its M/A (prior close +18.61%)—Buy signal effective 07/22/2020

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

Contact Ulli