ETF Tracker StatSheet

You can view the latest version here.

GLIDING INTO THE WEEKEND

- Moving the markets

Quadruple witching day provided much volatility, but the fallout was barely worth mentioning with the major indexes slipping moderately but closing the week on the plus side of the ledger.

Added CNBC:

The stock market experienced massive volume on Friday as Tesla’s historic entry into the S&P 500 will be based on prices at the close. There will be a rush of activity into the final bell and the S&P 500 will begin trading with Tesla as a member on Monday.

While that sounds simple, we may see the markets display more violent swings, as the inclusion will have its challenges:

With a market capitalization of more than $600 billion after a 700% rally this year, the electric carmaker will be joining as the seventh-largest company in the index.

Tesla is being added to the benchmark in one fell swoop, marking the largest rebalancing of the S&P 500 in history. It’s estimated that passive funds tracking the S&P 500 will need to buy more than $85 billion of Tesla, while selling $85 billion of the rest of the index to make room for it.

In the latest vaccine news, we learned that the FDA overwhelmingly backed Moderna’s Covid product, which would be a key step towards public distribution approval. Some inoculations were already given with Pfizer’s vaccine.

Hope continues to reign supreme that the rising Covid cases in combination with disheartening econ data would push the warring factions in Washington into finalizing a new aid package. Discussions about the current proposed $900 billion plan are still ongoing, despite federal funding lapsing at 12:01 am EST on Saturday.

Small and MidCaps continued their ascent to higher levels, as weakness in the major indexes did not affect those sectors. 10-year bond yields spiked towards their overhead resistance level of 0.95%, however, should a solid break above that level occur in the future, equities will be negatively affected.

The US dollar resumed its zig-zagging path of December and managed to bounce off its low level, thereby taking some starch out of gold’s recent rebound. None of this impinged on silver, which broke back above its highest level in 3 months, as Bloomberg’s chart shows.

Again, the Tesla inclusion in the S&P index as of Monday will certainly create some havoc, but it looks like the current year-end rally will not be meaningfully interrupted.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

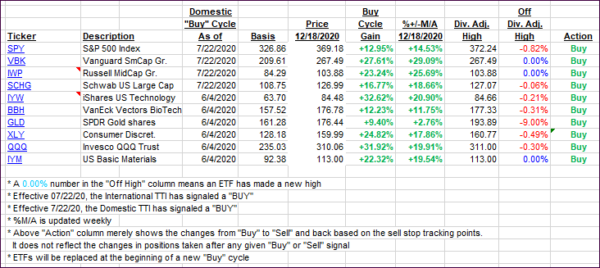

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs came off their all-time highs.

This is how we closed 12/18/2020:

Domestic TTI: +19.91% above its M/A (prior close +21.76%)—Buy signal effective 07/22/2020

International TTI: +18.62% above its M/A (prior close +20.53%)—Buy signal effective 07/22/2020

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

———————————————————

Back issues of the ETF Tracker are available on the web.

Contact Ulli