ETF Tracker StatSheet

You can view the latest version here.

S&P 500 Scores A Record Close

- Moving the markets

Hope reigned supreme that a hypothetically effective vaccine will become reality and cause the economy to recover some time next year, which would benefit stocks.

“This week’s positive vaccine news is a game-changer in our view, as it allows the market to look through the recent surge in COVID-19 cases to the impending end of the pandemic and broader reopening of the economy,” opined Marko Kolanovic, JPMorgan’s head of macro quantitative and derivatives strategy, who was among the first to call the market’s turn in March.

That was the theme today, and the major indexes rallied over 1%, with the Nasdaq lagging at first, then picking up steam but still ending up in 3rd place. For the week, the S&P 500 added +2.2%.

Still, concerns are mounting over the continued strict social distancing measures with some mayors suggesting cancelling Thanksgiving and staying indoors, while others issued new curfews on bars, restaurants, and gyms. That means, if the much-touted vaccine does not arrive as anticipated, you can kiss the hoped-for economic recovery goodbye.

The Energy sector soared to its best week ever, joined by nice pops in Airlines and Banking, while FANG stocks suffered. The 30-year bond yield dropped, and the US dollar closed higher. After Monday’s slam down, gold worked its way back but fell short of reclaiming the $1,900 level.

But not all is hunky dory, as ZH reported:

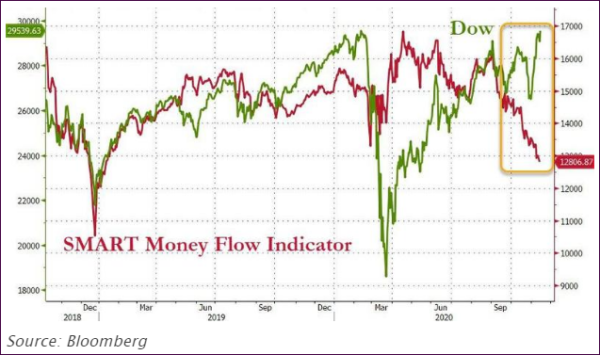

The US Macro Surprise Index is slipping, the Baltic Dry Freight Index is in retreat mode, which brings up the question: “Is this why the smart money is exiting the markets?”

Given the above, it’s wise to approach this market with caution and not with reckless abandon.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

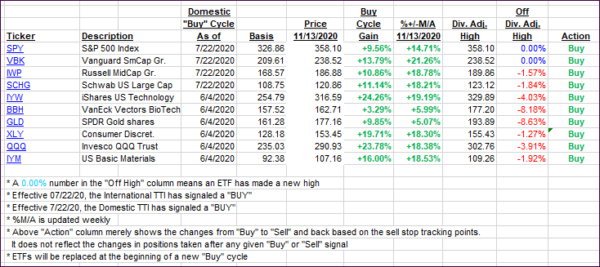

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs surged with the Domestic one scoring a new all-time high.

This is how we closed 11/13/2020:

Domestic TTI: +17.41% above its M/A (prior close +14.98%)—Buy signal effective 07/22/2020

International TTI: +14.17% above its M/A (prior close +12.83%)—Buy signal effective 07/22/2020

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

———————————————————

Back issues of the ETF Tracker are available on the web.

Contact Ulli