- Moving the markets

The markets took a steep dive right after the opening, with the Dow down some 300 points, after which a slow but choppy ascent pulled major indexes out of the doldrums, but they fell short of reclaiming their respective unchanged lines.

The culprits for the early weakness were the same as yesterday, namely no progress among the warring parties regarding the stimulus package and renewed threats of lockdowns in those areas with most of the new Covid-19 cases.

Reported CNBC:

“Market volatility is set to continue in the weeks ahead as investors brace for a host of uncertainties—the timing of vaccine availability (after a setback for Johnson & Johnson), the size and timing of additional US fiscal stimulus, and the election outcome,” wrote Mark Haefele, chief investment officer of global wealth management at UBS. “The uneven recovery in the US economy also adds to investor concerns as the results season kicked off this week.”

Headlines were in chaos mode adding to market uncertainty. Here are a few I came across:

- WHO Europe Director Says Governments Should Stop Enforcing Lockdowns

- European governments reinstate pandemic restrictions to curb a second wave of the coronavirus.

- Behind The Nasdaq Weakness: Goldman Downgrades Tech To Neutral

- Twitter, Facebook Go Full Tilt Protecting Biden Just Weeks After Execs Join Transition Team

- Senate Judiciary To Subpoena Jack Dorsey After Twitter Suspends Trump Campaign, House GOP Accounts Over Biden Scandal

- Traders Rattled After Morgan Stanley Sees 80% Odds Result Won’t Be Determined On Election Night

Not helping was the jobless claims report showing that almost 900k Americans filed for first-time benefits last week, which was worse than the 825k expected.

But that’s only part of it with ZH adding this important fact:

So, that’s the reported data – do with it what you will, depending on your agenda – but bear in mind that it is practically useless noise given the fact that issues with data from California, the most populous state, continue to remain frozen as they deal with the massive fraud that permeated their unemployment rolls.

I believe that volatility will ramp up over the next few weeks, which is why I took the opportunity to ease up on our market exposure by liquidating one of our holdings to lock in profits before they might turn into losses.

I think a more measured approach in this highly uncertain environment is advisable. After all, I see the downside risk as a graver danger as opposed to a couple percentage points of gains to be made on the upside—at least for the next 3 weeks.

The insanity is sure to continue.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

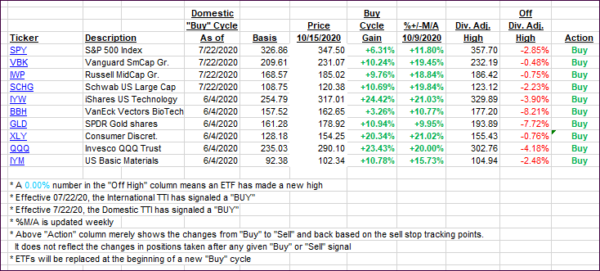

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs were mixed with the Domestic one gaining and the International one fading.

This is how we closed 10/15/2020:

Domestic TTI: +10.88% above its M/A (prior close +10.38%)—Buy signal effective 07/22/2020

International TTI: +5.49% above its M/A (prior close +6.47%)—Buy signal effective 07/22/2020

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

Contact Ulli