- Moving the markets

After its worst week since March, the tech sector managed to bounce back, along with the other major indexes, to end the session solidly in the green but off the intra-day highs.

The big jump happened right after the opening on news of corporate deal making and improved prospects for a Covid-19 vaccine involving a host of companies. The arrival of any product is uncertain, as is the question as to how quickly a successful vaccine candidate can be mass produced and distributed. In other words, I am hearing nothing but hype.

ZH added this:

Global stocks are coming off the back of the first consecutive weeks of declines since March and traders remain on edge given the recent reassessment of valuations and volatility in options markets, however late last week, analysts at Goldman, JPMorgan and Deutsche Bank all suggested the recent pullback in the U.S. is nearing an end. On Wednesday, the Federal Reserve is expected to maintain its dovish stance on policy as investors look for signs the global economy is recovering from the pandemic.

However, as important is the answer to the question whether the warring parties can agree on a stimulus package prior to the election. If not, there would be political fallout, as well yet to be determined effects on the markets, none of which I see as positive. On the other hand, we may just witness the usual political grand standing, after which one of parties will cave and compromise.

In the meantime, today’s advance was clearly supported by another short squeeze with “most shorted” stocks rebounding some 3% on the session. Gold had a nice showing as well with GLD adding +0.78%.

On a personal note, I will be out tomorrow afternoon and not be able to write the market commentary, however, regular posting will resume on Wednesday.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

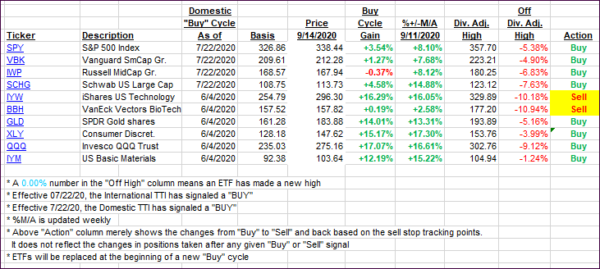

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs joined the bullish theme and rebounded nicely.

This is how we closed 09/14/2020:

Domestic TTI: +7.31% above its M/A (prior close +5.61%)—Buy signal effective 07/22/2020

International TTI: +6.11% above its M/A (prior close +5.04%)—Buy signal effective 07/22/2020

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

Contact Ulli