ETF Tracker StatSheet

You can view the latest version here.

STUMBLING INTO THE WEEKEND

- Moving the markets

Sloppy and choppy best describes the swan dives the major indexes did today, as the S&P 500 gave up gains made early in the week and closed with a modest loss of some -0.66%.

A last hour bounce back, however, helped the major indexes trim their losses.

As I pointed out yesterday, today being a quadruple witching expirations session contributed much to the volatility and caused one of our holdings to bounce against its trailing sell stop. Depending on the follow up action next Monday, this position may be liquidated.

In the end, equities are down for the 3rd week in a row with the Dow now having lost 3% YTD, while the S&P 500 is up just over 2% YTD.

Some point to the Fed’s balance sheet as the dominator for tech advances or tech declines, which Bloomberg’s chart makes abundantly clear. The implication is obvious. Either the Fed continues its balance sheet expansion, or the Nasdaq will continue with its best imitation of a swan dive.

Gold saved the day by closing in the green, but while the precious metal is stuck in a triangle pattern, it sure looks that a breakout is about to happen in the near future.

Contributing to the overall market weakness was the stimulus battle with the Dems sticking to their demand of at least $2.2 trillion for the next corona relief bill, while the White House showed willingness to settle at the $1.5 trillion level.

Noted analyst Charlie McElliott:

“In short, while a stimulus bill may be delayed – at least until the election – it is only a matter of time before it passes, with the final bill likely to be far greater than the $2.2 trillion some have tentatively priced in.”

While that maybe so, a delay could have more of an economic impact than anticipated, as in people running short of money, which in turn will dampen econ forecasts and subsequently affect markets negatively.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

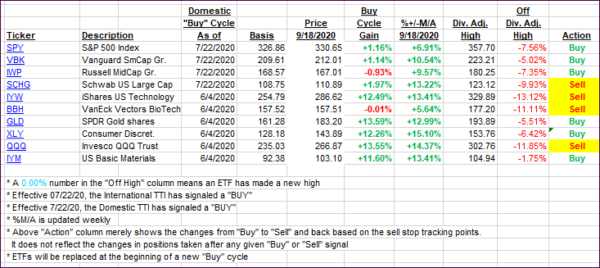

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs slipped as equities retreated broadly.

This is how we closed 09/18/2020:

Domestic TTI: +6.48% above its M/A (prior close +7.67%)—Buy signal effective 07/22/2020

International TTI: +5.22% above its M/A (prior close +5.84%)—Buy signal effective 07/22/2020

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

———————————————————

Back issues of the ETF Tracker are available on the web.

Contact Ulli