ETF Tracker StatSheet

You can view the latest version here.

A STRONG WEEK ENDS WITH A WHIMPER

- Moving the markets

Market weakness finally showed up, which snapped a four-day winning streak, with a stronger than expected jobs report failing to keep the bullish momentum going.

It appeared that the effects of the coronavirus took centerstage again with reports announcing that some 400 million people are on a mandatory lockdown in China with only limited permission to venture outside their homes to buy essential supplies.

Of course, that brings into question as to whether there have “only” been 638 deaths with the real number being much higher. Be that as it may, the market pullback was modest compared to recent gains.

Here at home, today’s payroll numbers crushed expectations of 165k by coming in at 225k, which was well above last month’s upwardly revised number of 142k. Noteworthy, was the rebound in hourly earnings, which exceeded last month’s upwardly revised 3.0% by reaching 3.1%.

Despite these good numbers, equities continued to slide after 4 days of aggressive gains with the S&P 500 still adding some +3.2%, while the major indexes also scored new all-time highs yesterday.

The jobs report boosted overall confidence in the economy and offset the negative reports from the coronavirus, however, it remains questionable if or when the virus will extract its pound of flesh from the markets.

If so, it will be interesting to see, if the Fed adds even more liquidity in order to maintain the bullish theme, such as the Peoples Bank of China just did with their $244 billion injection to stem any potential downturn.

Today’s letdown was in part attributable to the 4-day short-squeeze having run out of ammo, as Bloomberg’s chart clearly demonstrates.

I think the coronavirus may have the potential to temporarily interrupt if not derail stock markets, if some means of containment does not take place. After all, soon 80% of the Chinese economy may not be working and 90% of exports may no longer be functioning with supply-chain effects possibly snowballing.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can again.

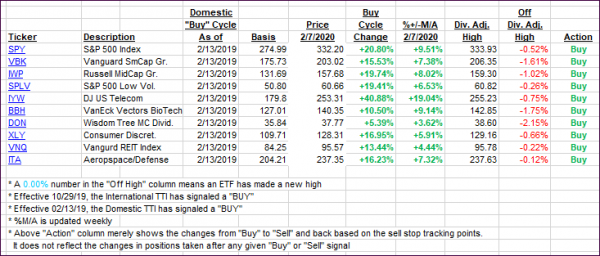

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) slipped off their highs, as upward momentum was non-existent today.

Here’s how we closed 02/06/2020:

Domestic TTI: +7.05% above its M/A (prior close +8.25%)—Buy signal effective 02/13/2019

International TTI: +5.26% above its M/A (prior close +5.25%)—Buy signal effective 10/29/2019

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

———————————————————

Back issues of the ETF Tracker are available on the web.

Contact Ulli