- Moving the markets

The markets were trading in the red for most of the session, as the latest trade headlines pushed equities further south and then gave traders hope that optimism is warranted.

When things looked bleak at mid-day, Reuters managed to provide the algos with some ammo to drive the indexes out of the doldrums and back up to their respective unchanged lines using the following:

- CHINA’S WANG YI SAYS HOPES BOTH SIDES CAN TAKE ‘MORE ENTHUSIASTIC MEASURES,’ REDUCE PESSIMISTIC LANGUAGE AND ACTIONS IN TRADE DISPUTE – RTRS

- CHINA’S WANG YI SAYS ‘IF EVERYONE DOES THIS, TALKS WILL NOT ONLY RESUME, BUT WILL PROCEED AND YIELD RESULTS’

Despite that effort, the unchanged lines proved to be overhead resistance, and we sold off into the close, but with only modest losses.

Adding to the negative early sentiment was the Trump Administration confirming that it’s “unlikely to extend temporary wavers to supply Huawei.” That reinforced that the US-China trade deal is simply not getting closer to an agreement, even though other headlines attempt to prove that a deal is close.

Real Estate provided some optimism when Pending Home Sales rose 2.48% YoY, which was the biggest annual jump since April 2016, but it was simply not enough firepower to restore bullish momentum.

The overnight liquidity shortage, also known as the funding disaster, keeps getting worse with the Fed as lender of last report supplying some $60 billion in liquidity after yesterday’s $92 billion.

No one has really come out to explain the source of the problem and if it might be just a quarter ending issue. MSM does not report about it, but somewhere the financial plumbing in our system has sprung a leak.

One analyst posed the thoughts that have been on my mind as well:

- It’s great that the Fed is pumping liquidity into the system, however, why were the existing operations insufficient?

- As of today, the Fed had injected $105 billion in liquidity into the Repo market, but rates were still stubbornly high. Whatever changed last week to cause the funding spikes is clearly still a problem.

If this problem is not resolved quickly but spreads even further, equity markets will eventually be negatively affected.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

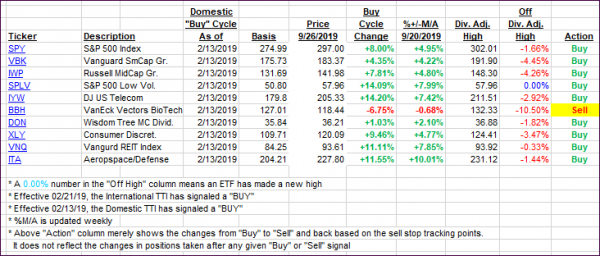

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) both slipped, as today’s rollercoaster ride ended up in the red.

Here’s how we closed 09/26/2019:

Domestic TTI: +3.82% above its M/A (prior close +4.07%)—Buy signal effective 02/13/2019

International TTI: +1.06% above its M/A (prior close +1.18%)—Buy signal effective 09/12/2019

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

Contact Ulli