ETF Tracker StatSheet

A SEA OF GREEN; TRADE TALK OPTIMISM IS ALIVE AND WELL

[Chart courtesy of MarketWatch.com]- Moving the markets

It sure seems that complacency rules supreme when it comes to market behavior with yesterday’s bad news, when a bombardment of economic data missed, either being forgotten or at best can be seen in the rear-view mirror. Trade talks between U.S. and China are current front-page news—not much else seems to matter.

Northman Trader summed it up like this:

Bad data doesn’t matter because stocks go up. A China deal will be positive and a catalyst to buy stocks. If there is no real China deal a cosmetic one is good enough. Since bad data doesn’t matter any good data is bullish too. In short, bad news is good news and good news is good news.

It’s blind faith in a system that never has to face any consequences as the central bank put reigns supreme.

Be that as it may, equities opened in a sea of green across world markets thanks to the usual support cast, namely optimism about the trade talks.

The major indexes vacillated above the unchanged line and were never in danger of breaking it to the downside, despite a short-lived mid-day pullback that seemed to do nothing but strengthen the bullish resolve.

The Dow managed to reclaim its 26k level and close above it, while the S&P 500 stormed higher, but did not quite reach its major overhead resistance area, namely the 2,800 zone.

Still, despite this levitation to ever new heights, I wonder if eventually fundamentals, on which stock prices are really based, will kick in and take the starch out of this exuberance. After all, forward earnings are collapsing while the US Macro Surprise Index is not in sync with the S&P 500.

But all that matters right now, however, is the long-term trend, which is up and supported by our Trend Tracking Indexes (TTI). It confirms that the bull is alive and well—at least for the time being.

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

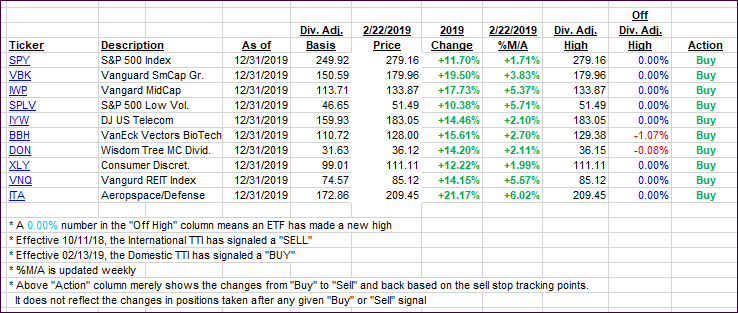

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how some our current candidates for this current ‘Buy’ cycle have fared:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) headed deeper into bullish territory.

Here’s how we closed 02/22/2019:

Domestic TTI: +3.47% above its M/A (last close +3.03%)—Buy signal effective 02/13/2019

International TTI: +1.44% above its M/A (last close +0.99%)—Buy signal effective 02/21/2019

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli