- Moving the markets

Friday’s market weakness continued through today with the major indexes getting spanked and surrendering just about all last week’s gains, which makes Wednesday’s robust bounce suspicious in terms of resumption of the bullish trend.

At least for right now, it appears to have been a giant head fake, just enough to generate a new “Buy” signal, as our Domestic TTI crossed its long-term trend line to the upside by a solid margin. As mentioned before, we got our feet wet via some conservative low-volatility ETF exposure, which has held up better than the S&P 500.

Several events have contributed to this sudden turnaround from bullish to bearish sentiment. For one, oil prices haven doing their best imitation of a swan dive and have reached a point that is 20% off their recent highs with prices barely hanging on to the $60 handle. That has been a shock to investors and brought up the so far unanswered question as to whether this is simply a result of a slowing global economy.

And, as we all know, the markets have elevated during the bullish periods of this year by a handful of big hitters like Amazon and Apple, along with the FANG stocks, all of which have seen corrections, which are magnified in the varies indexes due to their enormous market capitalizations.

Our Domestic TTI crossed is trend line to the downside by -1.52% (section 3) making it questionable whether the current “Buy” signal can be maintained. I will watch the market for a day of two, but will act quickly to liquidate our position, should more downside come into play.

This entire situation of directionless trending reminds me of the dot-com bubble, which burst in 2000, when we had 3 whip-saw signals before the bear market finally established itself and lasted around 17 months. As frustrating as it is to some, this is exactly why we must participate in all “Sell” signals, so that we have a chance of avoiding financial disaster whenever it strikes.

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

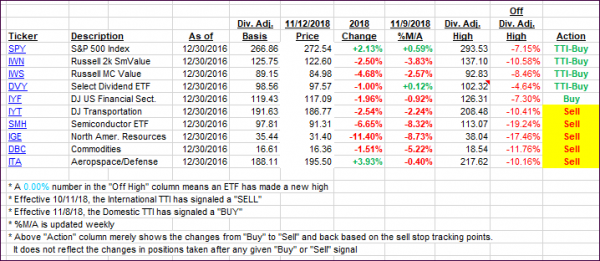

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how our candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) headed south as bullish momentum was absent for the entire session. I will track market activity but will act quickly to get us out of our current holdings should the sell-off continue unabated, which would then end this current “Buy” cycle.

Here’s how we closed 11/12/2018:

Domestic TTI: -1.52% below its M/A (last close +0.01%)—Buy signal effective 11/08/2018

International TTI: -4.55% below its M/A (last close -3.04%)—Sell signal effective 10/11/2018

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli