[Chart courtesy of MarketWatch.com]

- Moving the markets

The was no question as to what the driver was to pull the markets down in no uncertain terms. As I cautioned just yesterday, surging bond yields will affect markets eventually, and that moment arrived today as the 10-year yield catapulted towards the 3.23% level, but it eventually settled at 3.19% up 3 basis points from yesterday’s close.

The major indexes slumped with the Dow at one point being down 357 points, or 1.3%, but buying set in and some of the mid-day losses were reversed. Nevertheless, red was the color of the day with the Nasdaq experiencing the brunt of the sell-off with -1.81%.

The spike in bond yields may not be over and “stock markets are entering the danger zone,” according to Bloomberg. What that means is that stocks can only handle yields rising to a certain point before being adversely affected. No one knows where that level is, but I think we’ll be soon finding out that moment of truth should bond yields rise further.

With the Nasdaq slumping the most, it comes as no surprise that the FANG stocks were hammered—not just today, but since the beginning of the month. Semiconductors followed suit with SMH dropping -2.25% and closing below its 5-month uptrend line. In the meantime, the US Dollar did a dump-and-pump and closed higher on the day.

Again, bond investors saw the widely held TLT lose another -0.71% and not just making a new low for 2018 but also increasing the YTD loss to -9.48%. Ouch!

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

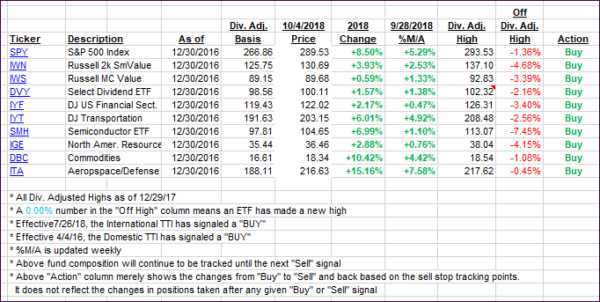

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how our candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) headed south as bullish momentum was nowhere to be found.

Here’s how we closed 10/04/2018:

Domestic TTI: +3.54% above its M/A (last close +4.26%)—Buy signal effective 4/4/2016

International TTI: +0.37% above its M/A (last close +0.96%)—Buy signal effective 7/26/2018

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli