ETF Tracker StatSheet

https://theetfbully.com/?p=18630&preview=true

STRUGGLING FOR DIRECTION

[Chart courtesy of MarketWatch.com]- Moving the Markets

Struggling for direction was the theme only of the past week but also for today as the headline of the US adding 235k jobs in February ramped markets higher right out of the gate. Expectations of 200k were solidly beat and even the whisper expectation of 233k was conquered. The unemployment rate remained at 4.7%.

Despite the great headline number, the markets sold off mid-day as a look under the hood revealed that the growth in average hourly earnings came in at 0.2% MoM against expectations of a 0.3% increase. Still, on a YoY basis expectations were met. The bottom line is that the numbers should be good enough for the Fed to hike next week.

Here’s ZH with more details:

There has been a distinct shift in the composition of job gains in the first full job report under Donald Trump: whereas in the recent past, jobs under Obama were mainly focused in low-paying, minimum-wage categories, such as retail, hospitality, education and, of course, food service and drinking places, in February there was a notable change with some of Trump’s favorite sectors, such as manufacturing and construction posting dramatic gains.

Let’s wait and see if this potential game changer can generate enough momentum in the face of higher interest rates, a weakening retail sector, crashing crude oil, collapsing high yield bond prices and a slipping GDP that points decidedly in a southerly direction.

Other than that, everything is great, despite the rate hike odds for June having now grown to 50%. Go figure…

- ETFs in the Spotlight (updated for 2017)

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

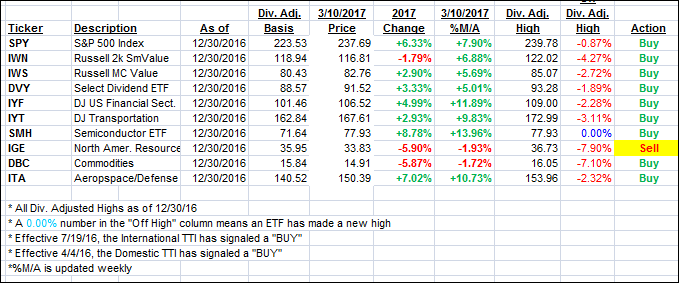

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how the 2017 candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) recovered and headed north as the trend reversed late in the session.

Here’s how we closed 3/10/2017:

Domestic TTI: +2.68% (last close +2.51%)—Buy signal effective 4/4/2016

International TTI: +5.64% (last close +5.04%)—Buy signal effective 7/19/2016

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli