ETF/No Load Fund Tracker StatSheet

————————————————————-

————————————————————

Market Commentary

MARKETS REMAIN DISTRACTED ON BREXIT

1. Moving the Markets

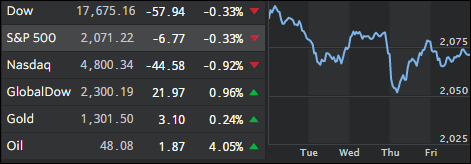

U.S. stocks posted losses today as Wall Street’s attention continues to focus on next week’s closely watched vote in Great Britain on whether to leave the European Union. Overall, this week was very volatile based on global events making it questionable as to whether we’ll see some stability as we head further into the summer months. This is the time to have your exit strategy in order, should the bears gain the upper hand during this notoriously weak season for the market.

In M&A news today, we heard that one of the nation’s best-known cosmetics manufacturers, Revlon (REV), is going to buy Elizabeth Arden (RDEN) in $419.3 million deal. The $14-a-share deal establishes the value of Elizabeth Arden at about $870 million, including debt, according to Revlon. Revlon said in a statement that it expects to reduce $140 million in redundant costs between the two companies, which will take three to five years to realize.

U.S. Crude, which had closed lower the first four days of the week, settled up Friday by nearly 4% to $47.98 per barrel, trimming its losses for the week from nearly 6% at Thursday’s close to -2.2% at week’s end.

In economic news, May housing starts in the U.S. fell but still topped estimates. Housing starts fell 0.3% to a seasonally adjusted 1.164 million units, which topped the 1.150 million units economists’ had forecast.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

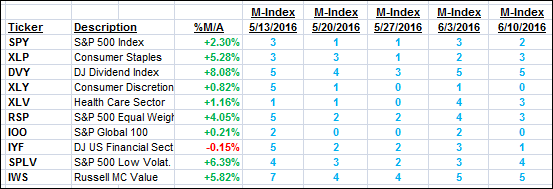

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

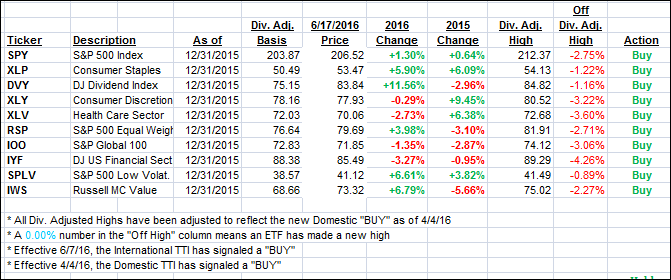

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Domestic Trend Tracking Index (TTI) lost some upward momentum as global markets went into retreat mode. The International one dropped back below its line and into bear market territory. As I posted previously, I am watching this one closely and will most likely pull the trigger on this current Buy signal by mid-week, unless bullish momentum resumes.

Here’s how we closed:

Domestic TTI: +1.31% (last Friday +1.93%)—Buy signal effective 4/4/2016

International TTI: -1.08% (last Friday +0.30%)—Buy signal effective 6/7/2016

Have a great weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli