1. Moving the Markets

Financial markets have held up well so far this week after the attacks in Paris Friday that sparked global concern about the economic impact of terrorism. Stocks moved higher Wednesday after the release of the Fed minutes of October, as the Dow logged a third straight day of gains and the S&P 500 moved back into the black for the year.

According to minutes of its October 27-28 meeting, the Federal Reserve policymakers agreed that the economy and labor market “could well” be strong enough to withstand a hike in interest rates in December. The officials said global troubles had eased and a delay could increase market uncertainty and undermine confidence in the economy.

The Fed also has expressed concern about persistently low inflation and said it must be reasonably confident inflation will return to the Fed’s 2% goal in the medium-term. That’s all it took and equities went into rally mode. Of course, we know that the Fed and not economic data determine market direction, as general macro data are showing anything but strength. Some analysts seem to think that the Fed needs to hike in order to save face; after all, you can only cry “wolf” so many times before you lose credibility.

Be that as it may, the question for us is whether the reboud of the last 3 days will provide enough momentum in order to break us out of the trading range in which we’ve been stuck for several weeks. With the Domestic TTI now having ventured again above its trend line by a fraction, after spending only 5 days below it, I will want to see more staying power accompanied by a stronger piercing of the line before issuing a new “Buy.” Stay tuned for more details.

All of our 10 ETFs in the Spotlight jumped higher with the leader being Healthcare (XLV) with a gain of +1.95%, while the Dividend ETF (DVY) lagged a little but gained +1.34%.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

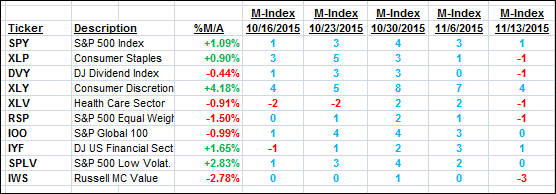

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

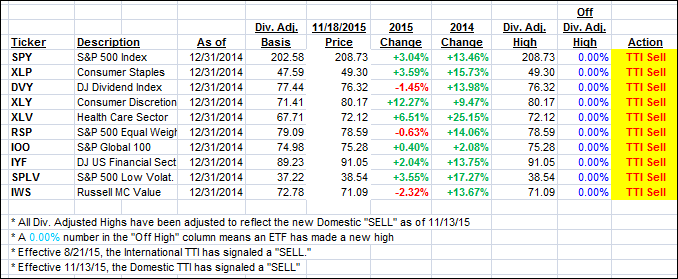

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

After only 5 days below its long-term trend line, our Domestic Trend Tracking Index (TTI) crawled back above it by a fraction of a percent. I will watch for futher upward momentum and a clearer piercing to the upside before issuing a new “Buy.” I want to make certain that this breakout is for real before taking new positions.

Here’s how we ended up:

Domestic TTI: +0.25% (last close -0.52%)—Sell signal effective 11/13/2015

International TTI: -3.42% (last close -4.32%)—Sell signal effective 8/21/2015

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli