ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

Friday, January 9, 2015

MARKETS COULDN’T HOLD MOMENTUM TO FINISH THE WEEK

[Chart courtesy of MarketWatch.com]1. Moving the Markets

Volatility has been the name of the game thus far as we round out the second week of trading in 2015. After two straight days of gains and a revived bullish sentiment, all major indexes tumbled back into the red today. Looking back on the week, you may remember that the DOW took a major dive on Monday and Tuesday before mounting a 536 point rebound on Wednesday and Thursday.

In economic news, the slower-than-usual economic recovery still shows signs of acceleration, giving it strength to last longer than average. The U.S. economy added 256,000 jobs in December, slightly above the expected increase of 240,000. In addition, the unemployment rate dropped to 5.6% from 5.8%, although much can be contributed to people dropping out of the labor pool.

For all you BitCoin lovers, BitStamp, the world’s third-largest bitcoin exchange, saved its reputation today by reopening for business within a week of losing upward of $5 million worth of bitcoins due to a security breach. CEO Nejc Kodric was quoted today saying that the new service will be “safer and more secure than ever,” and this includes new cloud support from Amazon.

In the week to come, inflation readings will get the bulk of the attention, as declining energy prices have dampened inflation readings and expectations as of late. The PPI will be released on Thursday followed by the consumer price index on Friday. Other readings include the retail sales for December, consumer sentiment and industrial production. We’ll also get early figures on manufacturing activity in January from the Philadelphia and New York regions.

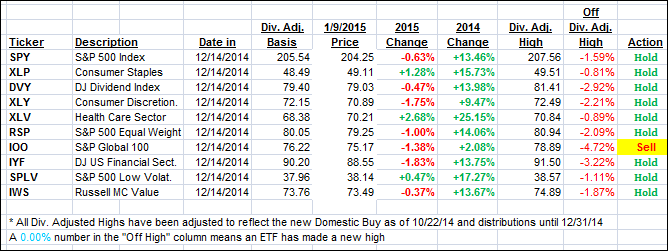

All of our 10 ETFs in the Spotlight headed lower today with financials (IYF) taking the lead with -1.26%. 3 of the 10 ETFs listed have managed to eke gains YTD as you can see in section 2.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

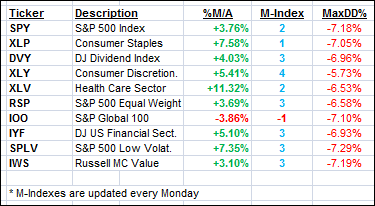

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

For the week, our Trend Tracking Indexes (TTIs) showed a mixed picture with the Domestic one staying just about even, while the International one slipped deeper into bear market territory.

Here’s how we ended this week:

Domestic TTI: +2.43% (last Friday +2.65%)—Buy signal since 10/22/2014

International TTI: -2.19% (last Friday -0.88%)—New Sell signal effective 12/15/14

Have a nice weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

Reader Ed:

Q: Ulli: Do you post a sell signal for US ETFS/Funds should it occur during the week, between newsletters?

A: Ed: Whenever a Buy or Sell signal occurs I post it to the blog the same day. It also gets emailed to all subscribers, but I recommend you check the blog when we appear to get close, since email delivery is not always very reliable.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli